Employment Earning Expenses Savings Education

Withdrawals from education savings plan accounts can generally be used at any college or university including sometimes at non-US. Disabled individuals figure the expense on Schedule A.

Variation In Earning Urban Institute

There are various rules governing the tax treatment of employment expenses.

Employment earning expenses savings education. You can use the ESA. Examples of tax-free educational assistance include. For example if you receive SSDI wages or other income you could set aside some of that money to pay expenses for education vocational training assistive technology used for employmentrelated purposes or starting a business as long as the expenses are related to achieving your work goal.

This benefit applies not only to qualified higher education expenses but also to qualified elementary and secondary education expenses. Qualified education expenses must be paid by. Funnel the savings into your nest egg.

Dont invest in anything you are uncomfortable with but see if you cant squeeze out better returns. Education savings plans let a saver open an investment account to save for the beneficiarys future qualified higher education expenses tuition mandatory fees and room and board. The cost of classes to prepare for a new line of work isnt deductible.

Employees who earned less than 8500. For every level of education from kindergarten to graduate school. Part-time may be enough.

Generally the taxable benefit was the cash amount you were able to convert the benefit into. Keep in mind if any of these expenses occur during your employment you might want to ask your employer if you can get these fees re-reimbursed by. These education categories reflect only the highest level of educational attainment.

Coverdell education savings accounts ESAs are tax-advantaged accounts that allow you to save money for education. Take a second job or work extra hours. For example if you were given a printer that originally cost.

Educational Savings Accounts ESAs are an ideal way for you to begin saving money to help a child grandchild or any young person pay for education expenses. Use any remaining qualified education expenses to claim an education credit. A Coverdell education savings account Coverdell ESA is a trust or custodial account set up in the United States solely for paying qualified education expenses for the designated beneficiary of the account.

They do not take into account completion of training programs in the form of apprenticeships and other on-the-job training which may also influence earnings and unemployment rates. Any education expenses you want to deduct must be related to maintaining or improving your skills for your existing business. A third party including relatives or friends.

Pell grants and other need-based education grants. To pay for education expenses at eligible schools. Pave the way for your childs education dreams to come true.

Annual contribution limit The contribution limit is 2000 per childbeneficiary. Qualified artists and government officials figure the cost of qualifying work-related education expense on Form 2106 Employee Business Expenses. You may not need to work full-time beyond your planned retirement age.

Here are some of the benefits. The rules were more generous for employees earning less than 8500. The earnings are tax-free if used for qualified education expenses.

You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Aim for high returns. Education Savings Accounts.

You or your spouse if you file a joint return A student you claim as a dependent on your return or. As it stands now the following employee or job related deductions CANNOT be applied with your 2020 return but are scheduled to return beginning with 2026 returns. Self-employed individuals include education expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or Schedule F Form 1040 Profit or Loss From Farming.

Start saving for their future education expenses today by opening an Oklahoma 529 College Savings Plan account. Tax-free parts of scholarships and fellowships. Any OCSP earnings are federal and Oklahoma income tax-free when they are used for higher education expenses like tuition living expenses books supplies and fees.

Top 7 Tax Tips You Must Know If You Are Self Employed Make Money Blogging Blog Resources Business Tax

Top 7 Tax Tips You Must Know If You Are Self Employed Make Money Blogging Blog Resources Business Tax

5 Advantages Of An Employer Tuition Reimbursement Program The Blueprint

5 Advantages Of An Employer Tuition Reimbursement Program The Blueprint

What Is Tuition Reimbursement How To Take Advantage Of The Benefits

What Is Tuition Reimbursement How To Take Advantage Of The Benefits

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

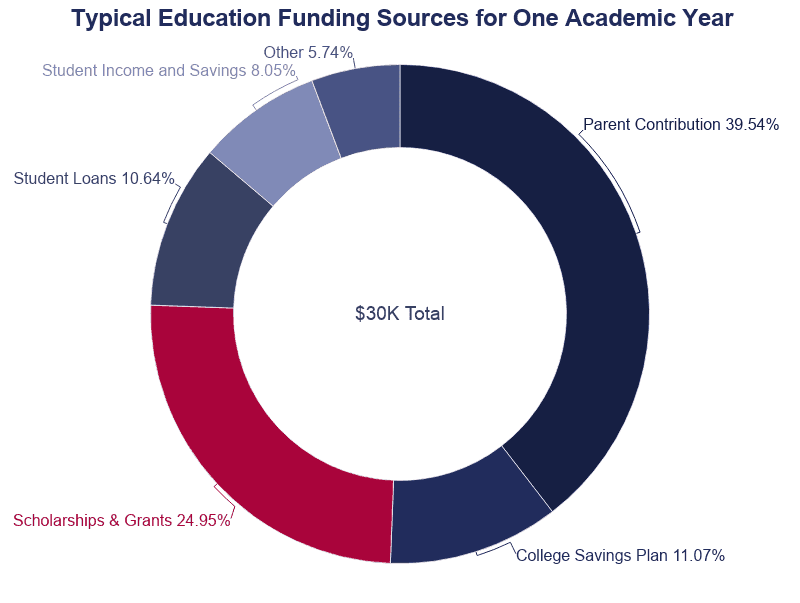

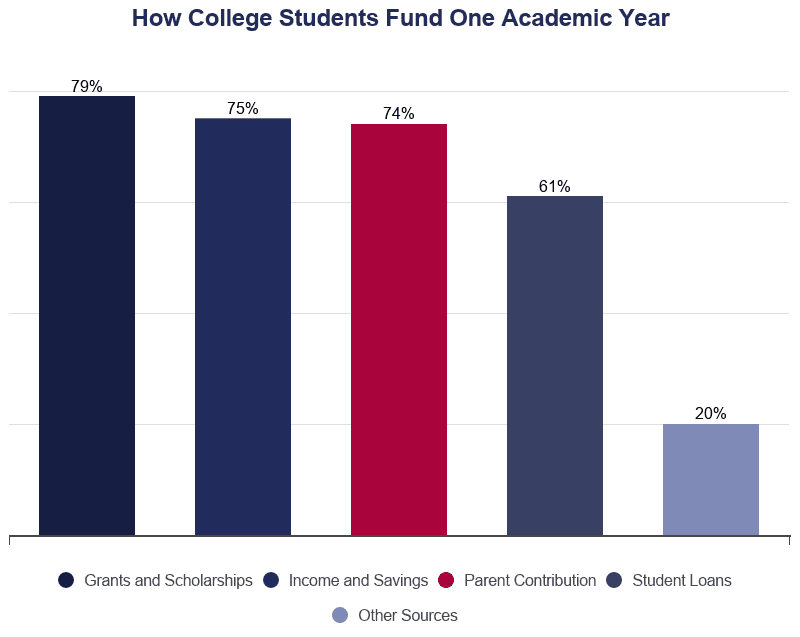

How People Pay For College 2021 Financing Statistics

How People Pay For College 2021 Financing Statistics

How Much Money Can You Save In Usa On H1b L1 Visa Living Cost Redbus2us

How Much Money Can You Save In Usa On H1b L1 Visa Living Cost Redbus2us

Forgone Earnings Urban Institute

For Workers Retirement Savings Education Campaign Saving Matters U S Department Of Labor

For Workers Retirement Savings Education Campaign Saving Matters U S Department Of Labor

Chapter 1 Five 5 Core Competencies Moneycounts A Penn State Financial Literacy Series

How People Pay For College 2021 Financing Statistics

How People Pay For College 2021 Financing Statistics

The Hierarchy Of Tax Preferenced Savings Vehicles

The Hierarchy Of Tax Preferenced Savings Vehicles

The Priority Pyramid Tells You Which Financial Goals To Tackle Now Financial Goals Financial Planning Financial

The Priority Pyramid Tells You Which Financial Goals To Tackle Now Financial Goals Financial Planning Financial

For Workers Retirement Savings Education Campaign Saving Matters U S Department Of Labor

For Workers Retirement Savings Education Campaign Saving Matters U S Department Of Labor

What S A 529 Plan Can I Offer A 529 Plan As An Employee Benefit Ask Gusto

What S A 529 Plan Can I Offer A 529 Plan As An Employee Benefit Ask Gusto

Four Awesome Benefits To Keep In Mind About The Thrift Savings Plan From Hermoneymoves Com Savings Plan How To Plan Retirement Savings Plan

Four Awesome Benefits To Keep In Mind About The Thrift Savings Plan From Hermoneymoves Com Savings Plan How To Plan Retirement Savings Plan

How To Reduce Labor Costs In Your Business

How To Reduce Labor Costs In Your Business

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Pay Statement Office Of Human Resources

Post a Comment for "Employment Earning Expenses Savings Education"