Self Employment Tax Form Cra

Whats new for small businesses and self. Last years notice of assessment or tax return.

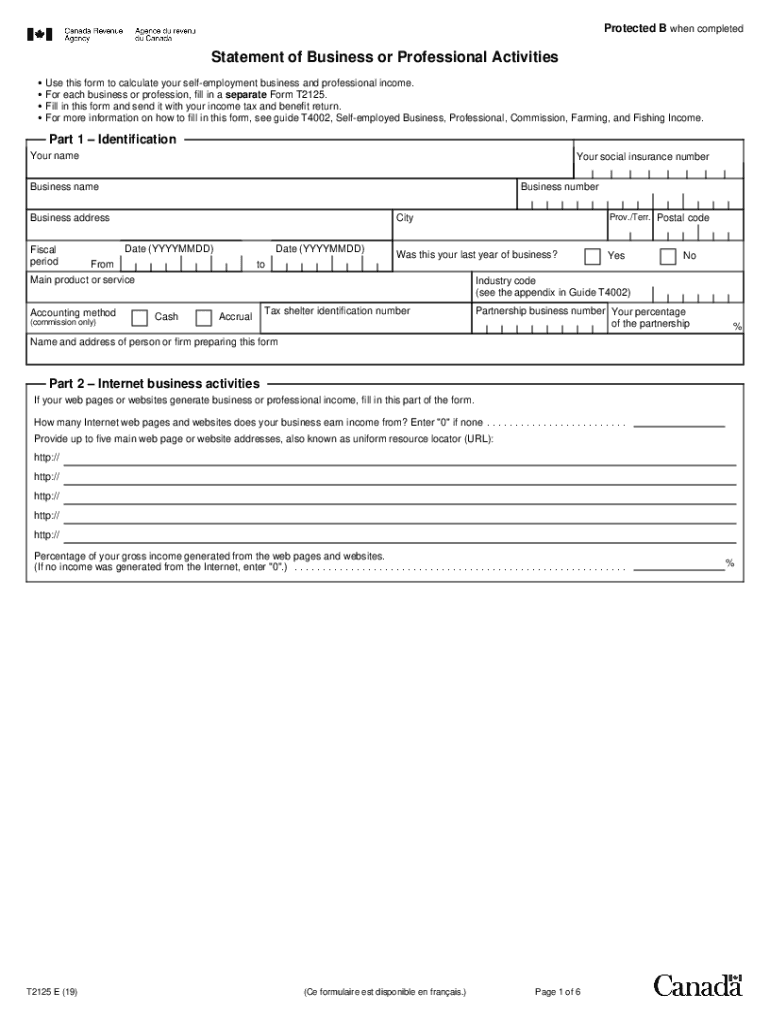

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

If you are starting a small business see the Checklist for new small businesses.

Self employment tax form cra. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. A ruling shows whether a worker is an employee or selfemployed and whether that workers employment is pensionable or insurable. Tax Tips for Ministers and Clergy Members.

The checklist provides important tax information. Form 1040 Department of the Treasury Internal Revenue Service 99 Self-Employment Tax Go to wwwirsgovScheduleSE for instructions and the latest information. Requesting a ruling If a worker or payer is not sure of the workers employment status either can ask the CRA for a ruling.

As a result its important to have your return ready to be filed by April 30 if you suspect you might owe taxes to the CRA. Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed.

What is Self-Employment Tax. Instead go to Corporations. What Are The Tax Forms for Self-Employed.

T2125 is a Canadian taxpayers form for reporting self-employment and professional income taxes. You can view this form in. Therefore one of the most essential self-employed tax documents is Form T2125 Statement of Business or Professional Activities.

More In Forms and Instructions. While all Canada Revenue Agency web content is accessible we also provide our forms and publications in alternate. About Schedule SE Form 1040 Self-Employment Tax.

If you are a member of the clergy you should receive a Form W-2 Wage and Tax Statement from your employer reporting your salary and any housing allowance. Once you earn self-employment income your tax return is due to the CRA by June 15 of the following year unless June 15 falls on a weekend or holiday however any taxes owing to the CRA are due by April 30. Some qualifying self-employed individuals whose net self-employment income was less than 5000 may.

Attach to Form 1040 1040-SR or 1040-NR. Without an industry code you cannot use the CRAs NETFILE to electronically file your return. Form T2125 Statement of Business or Professional Activities.

WASHINGTON The Internal Revenue Service announced today that a new form is available for eligible self-employed individuals to claim sick and family leave tax credits under the Families First Coronavirus Response Act FFCRA. Form T5013 Partnership Information Return. Understanding How Youre Affected by Self-Employment Tax.

No matter the structure of your self-employed business you will need to file a personal income taxes alongside other applicable returns. Self-employment income is reported on Form T2125 Statement of Business or Professional Activities and on this form there must be an industry code which corresponds to your main self-employed business activity. Self-employed individuals including those earning income from commissions.

This tax applies no matter how old you are and even if you are already getting social. T4002 Self-employed Business Professional Commission Farming and Fishing Income 2020. Gross income lines 13499 13699 13899 14099 and 14299 and Net income lines 13500 13700 13900 14100 and 14300 Report self-employment income or loss from a business a profession commission farming or fishing.

When you file your taxes as a sole prop your business income is treated as personal income and reported on your personal tax return Form T1 General Income Tax and Benefit Return. If your net earnings from self-employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions PDF. Line 10400 Foreign employment income.

Report income earned outside Canada from a foreign employer. Previous-year versions are also available. The same approach will apply whether the individual applied through the CRA or Service Canada.

You have to file an income tax return if your net earnings from self-employment were 400 or more. You figure self-employment tax SE tax yourself using Schedule SE Form 1040 or 1040-SR. If you are incorporated this information does not apply to you.

The T4002 contains information for self-employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return. Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. Name of person with self-employment income as shown on Form 1040 1040-SR or 1040-NR.

You must fill the T2125 with the T1 which covers income from regular employment. Most sole proprietorships fill the T2125 every year along with the T1 annual personal income tax. See General information for details.

IR-2021-31 February 8 2021. The income you earn as a self-employed person is listed on Line 104. When filing your taxes there are specific tax forms that those you fall under the self-employed category must fill in.

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. To ask for a CPPEI ruling you can.

The 2017 Free Tax Software Roundup For Canadians Www Redflagdeals Com Tax Deadline Income Tax Filing Taxes

The 2017 Free Tax Software Roundup For Canadians Www Redflagdeals Com Tax Deadline Income Tax Filing Taxes

Form Cra Combined Registration Application For State Of Delaware Free Download

Form Cra Combined Registration Application For State Of Delaware Free Download

How Do I Make Income Tax Payments To The Cra For My Business Accounting Firm Toronto Gta Accounting Professional Corporation

How Do I Make Income Tax Payments To The Cra For My Business Accounting Firm Toronto Gta Accounting Professional Corporation

Form Cra Fillable Combined Registration Application

Form Cra Combined Registration Application For State Of Delaware Free Download

Form Cra Combined Registration Application For State Of Delaware Free Download

2019 2021 Form Canada T2125 Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Canada T2125 Fill Online Printable Fillable Blank Pdffiller

Self Employed Here S How To File Your Taxes In Canada Bench Accounting

Self Employed Here S How To File Your Taxes In Canada Bench Accounting

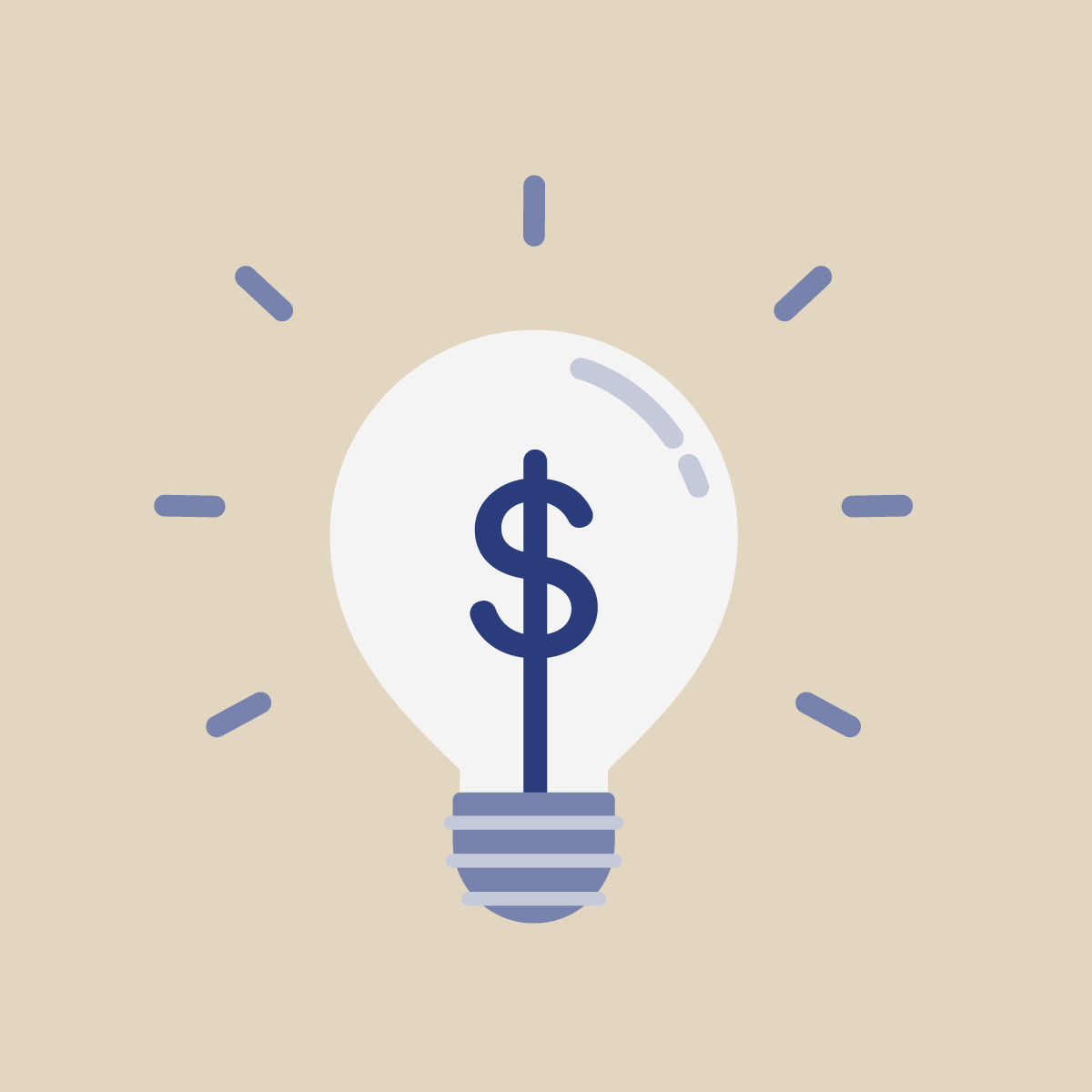

Freelance Taxes In Canada 10 Things You Need To Know

Freelance Taxes In Canada 10 Things You Need To Know

Freelance Taxes In Canada 10 Things You Need To Know

Freelance Taxes In Canada 10 Things You Need To Know

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

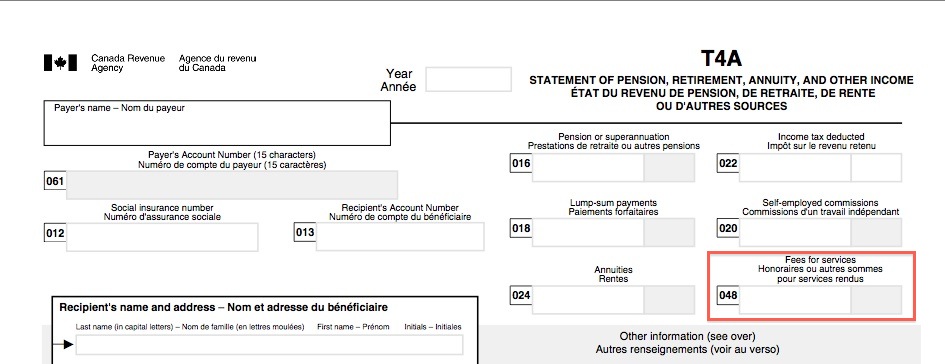

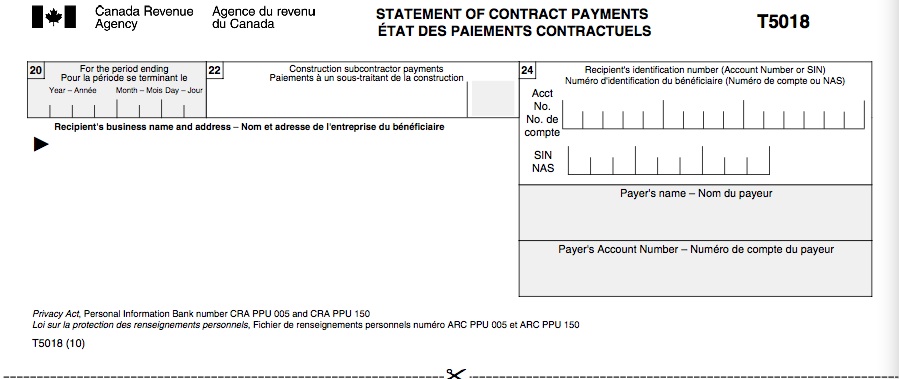

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

Form Cra Combined Registration Application For State Of Delaware Free Download

Form Cra Combined Registration Application For State Of Delaware Free Download

Pdf How Did The Cra Expect The Adoption Of Ifrs To Affect Corporate Tax Compliance And Avoidance Canadian Tax Journal 66 1 1 22 Http Www Ctf Ca Ctfweb En Publications Ctj Contents 2018ctj1 Aspx

Pdf How Did The Cra Expect The Adoption Of Ifrs To Affect Corporate Tax Compliance And Avoidance Canadian Tax Journal 66 1 1 22 Http Www Ctf Ca Ctfweb En Publications Ctj Contents 2018ctj1 Aspx

Understanding Your Cra Tax Return What S New In 2019 Mileiq Canada

Understanding Your Cra Tax Return What S New In 2019 Mileiq Canada

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

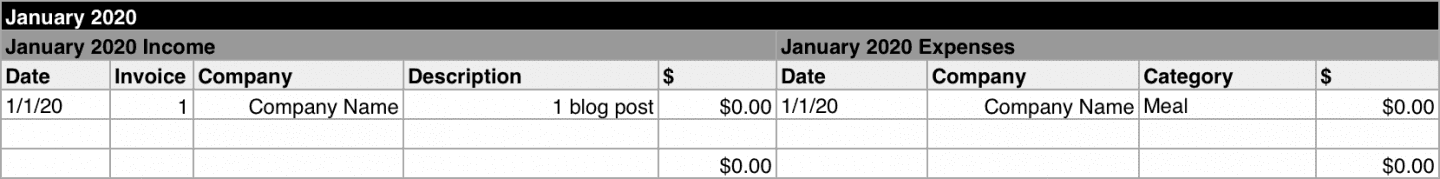

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge

Understanding Your Cra Tax Return What S New In 2019 Mileiq Canada

Understanding Your Cra Tax Return What S New In 2019 Mileiq Canada

2019 2021 Form Canada T2200 Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Canada T2200 Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Self Employment Tax Form Cra"