Withholding Tax Rates Kenya

Management or Professional Fee. Either 5 of the tax payable or.

Kra Itax Portal Online Tax Returns Login Registration And App Nyongesa Sande Tax Return Tax Payment Filing Taxes

Kra Itax Portal Online Tax Returns Login Registration And App Nyongesa Sande Tax Return Tax Payment Filing Taxes

The withholding tax rate applicable for sales promotion advertising and transportation services is 20 on the gross fees while reinsurance premiums are to be taxed at 5.

Withholding tax rates kenya. Introduction to What is Minimum Tax In Kenya. Income from a digital market place includes income accrued in or derived from Kenya. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125.

No VAT is withheld on exempt goods exempt services and Zero rated supplies. Deducted and remitted on or before the 20th of the following month. Any VAT withheld in exempt and Zero rated supplies is treated as tax paid in error and therefore refundable by the Commissioner.

On the next KShs 8333 per month or KShs 100000 per annum. 8 if the beneficiary holds at least 25 of. Withholding Tax Transactions in Kenya Withholding Tax transactions in Kenya includes the following.

The change reverses the provision in the Finance Act 2018 providing for withholding tax charge of 20 on demurrages payable by the person paying the demurrages to the non-resident ship owner. The various tax incentives for new listings or introductions on. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing.

Either 5 of the tax payable or twenty thousand shillings whichever is higher. The withholding tax rate is 5 for residents and 20 for non-residents. Interest when paid to both resident and non-resident persons is liable to withholding tax at 15 on the gross interest paid with the exception of interest from housing bonds to resident persons which is subject to withholding tax at the rate of 10 on the gross interest paid.

The Minimum tax is also being referred to as the 1 tax. Withholding tax measures aimed at taxing income of non-residents and income accrued from digital platforms. From 1 st January 2021 the country introduced Minimum tax in Kenya which was contained in the Minimum Tax Bill in 2020 and later published as law in the Finance Act 2020.

How do I pay for Withholding VAT. Withholding Tax is deducted at source from several income like. However the withholding tax rate on dividend payments to non-residents has been increased from 10 to 15.

Withholding VAT is charged at a the rate of 2 of the value of taxable supplies with effect from 07112019. Many people have questions about the Minimum tax in Kenya. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing.

On all income amounts in excess of KShs 32333 per month or KShs 388000 per. Currently the potion of VAT that is withheld is 2 out of the 14 VAT and the supplier is paid 12 14 -2 VAT. Deducted and remitted on or before the 20th of the following month.

0 0 0 Note that a rate of 49 applies in the case of interest and certain. Reduction andor elimination of tax incentives such as investment allowances and exemptions. What is exempt from Withholding Tax.

Kenya Tax Alert Tax Laws Amendment Bill 2020 April 2020. KRA will be carrying out sensitisation on the same at Times Tower 5th Floor on main hall on 22nd November 2019 at 900am. Reduction of income tax rates for both individuals and corporate entities.

On the First KShs 24000 per month or KShs 288000 per annum. Corporation tax rate reduced from 30 to 25 effective 1 st January 2020. Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents.

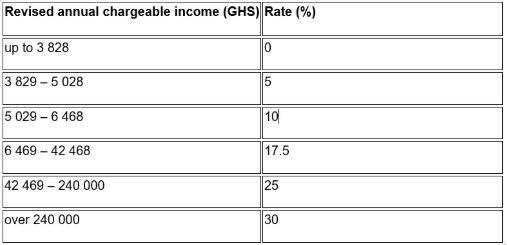

Individual Income Tax Bands and applicable rates. Taxation of Digital Economy. Deducted and remitted on or before the 20th of the following month.

Either 5 of the tax payable or twenty thousand shillings whichever is higher. The dates of training for regions outside Nairobi will be confirmed in due course. 25 rows No Kenya tax is due if subject to tax in Zambia.

The VAT withholding agents are legally expected to remit the withheld VAT on behalf of the suppliers to KRA within fourteen 14 days from the date of withholding the amount. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. In addition the Act has increased the withholding tax rate for dividends paid to a nonresident person from 10 to 15.

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

Amashusho Yerekana Umushinwa Ari Gukubita Umunya Kenya Yavuggishije Abatari Bake Kenyan Viral Videos Kenya

Amashusho Yerekana Umushinwa Ari Gukubita Umunya Kenya Yavuggishije Abatari Bake Kenyan Viral Videos Kenya

What Is Withholding Tax Employment Accounting Tax

What Is Withholding Tax Employment Accounting Tax

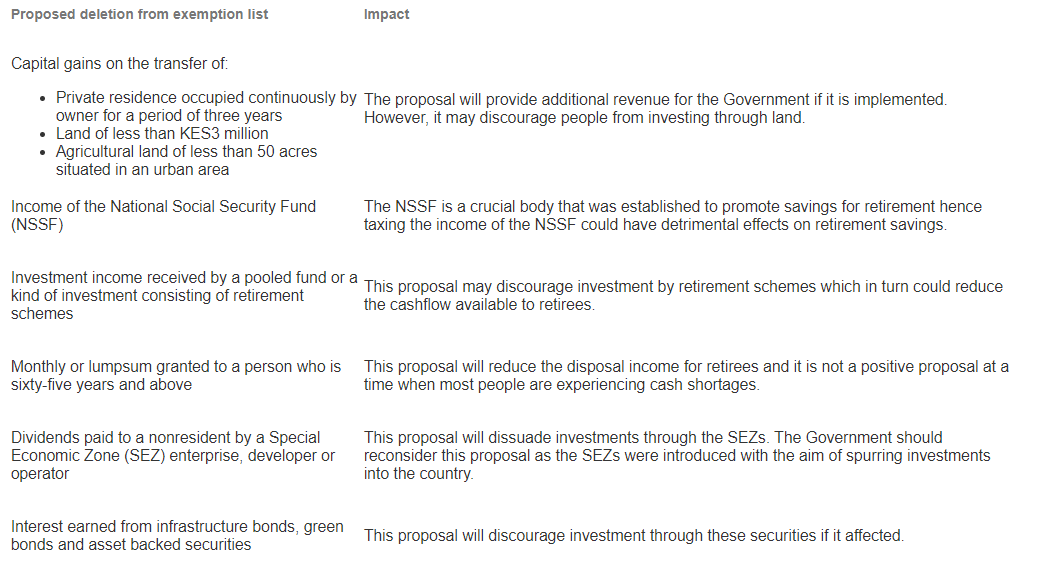

Kenya Proposes Tax Laws Amendments Bill 2020 Ey Global

Kenya Proposes Tax Laws Amendments Bill 2020 Ey Global

Kenya Proposes Tax Laws Amendments Bill 2020 Ey Global

Kenya Proposes Tax Laws Amendments Bill 2020 Ey Global

Opera Mini In Music Download Deal With Mdundo Companies Opera Mini In Music Download Deal With

Opera Mini In Music Download Deal With Mdundo Companies Opera Mini In Music Download Deal With

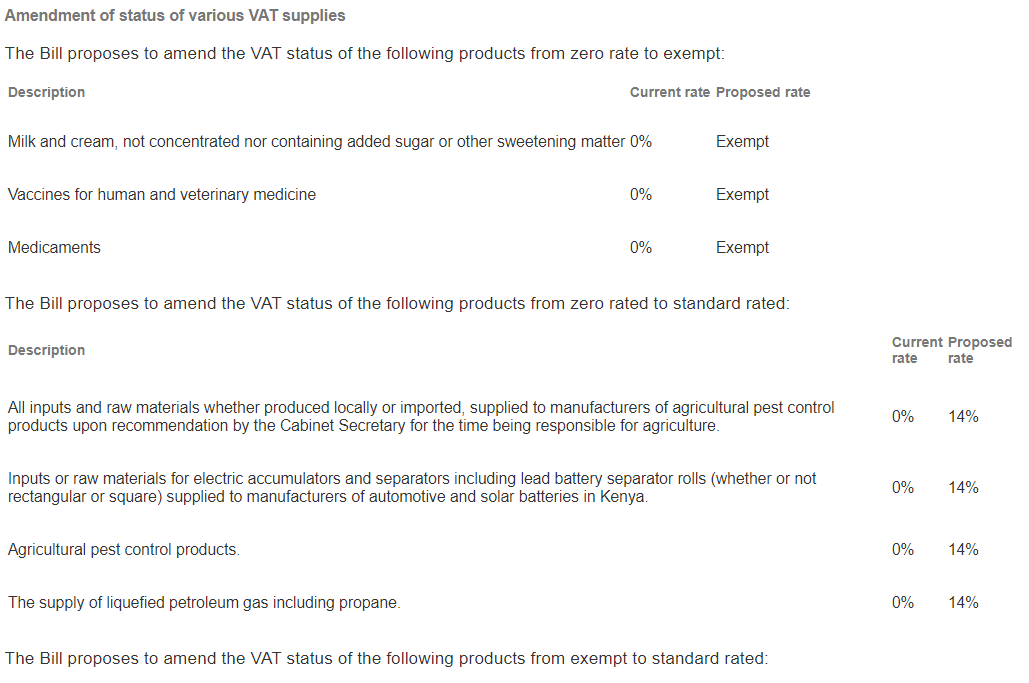

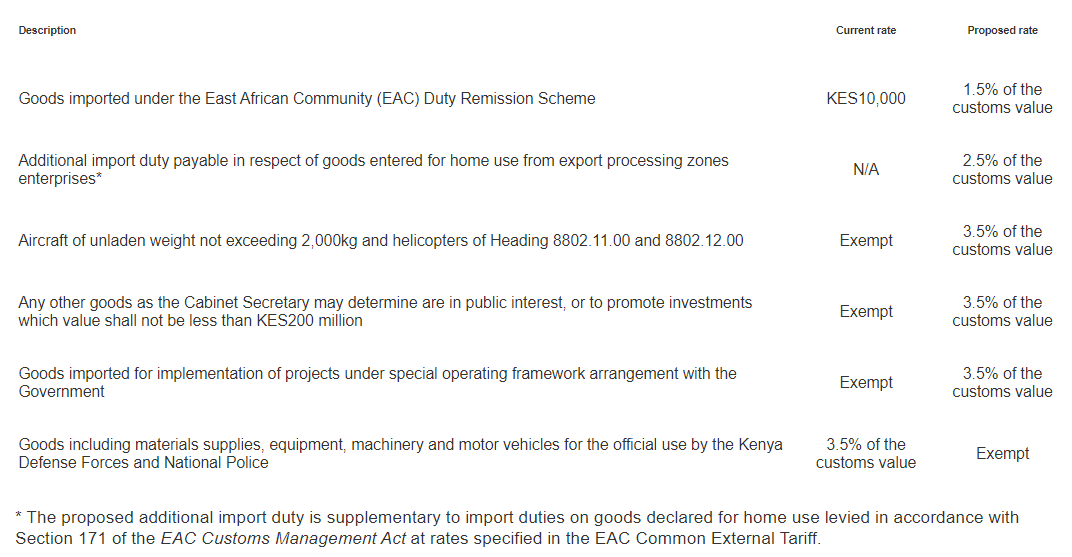

The Tax Laws Amendment Bill 2020 Rsm Kenya

The Tax Laws Amendment Bill 2020 Rsm Kenya

How To Automatically Fill Out Forms With Google Chrome Nyongesa Sande Clear Browsing Data Chrome Apps Saved Passwords

How To Automatically Fill Out Forms With Google Chrome Nyongesa Sande Clear Browsing Data Chrome Apps Saved Passwords

Simple Tax Guide For Americans In Kenya

Simple Tax Guide For Americans In Kenya

The Tax Laws Amendment No 2 Bill 2020

The Tax Laws Amendment No 2 Bill 2020

Pin By Kenya On Kenya Recipess Recipes Kenya Travel Kenya

Pin By Kenya On Kenya Recipess Recipes Kenya Travel Kenya

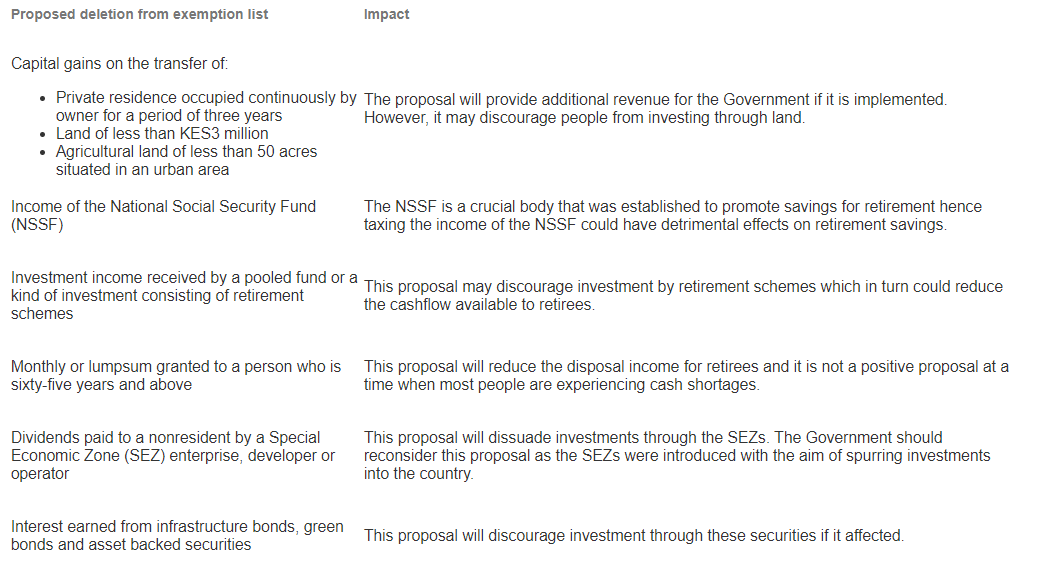

Kenya Proposes Finance Bill 2020 Ey Global

Kenya Proposes Finance Bill 2020 Ey Global

Simple Tax Guide For Americans In Kenya

Simple Tax Guide For Americans In Kenya

How To Pay Presumptive Tax In Kenya Winstar Technologies Business Tax Community Business Business Person

How To Pay Presumptive Tax In Kenya Winstar Technologies Business Tax Community Business Business Person

Understanding Expat Taxes For Americans Living In Kenya

Understanding Expat Taxes For Americans Living In Kenya

Post a Comment for "Withholding Tax Rates Kenya"