Withholding Tax Rates Mexico

Or for tax return help email us at CITTaxReturnHelpstatenmus. If the employee is considered a non-resident for Mexican tax purposes the tax rate applicable to compensation will vary from 15 to 30.

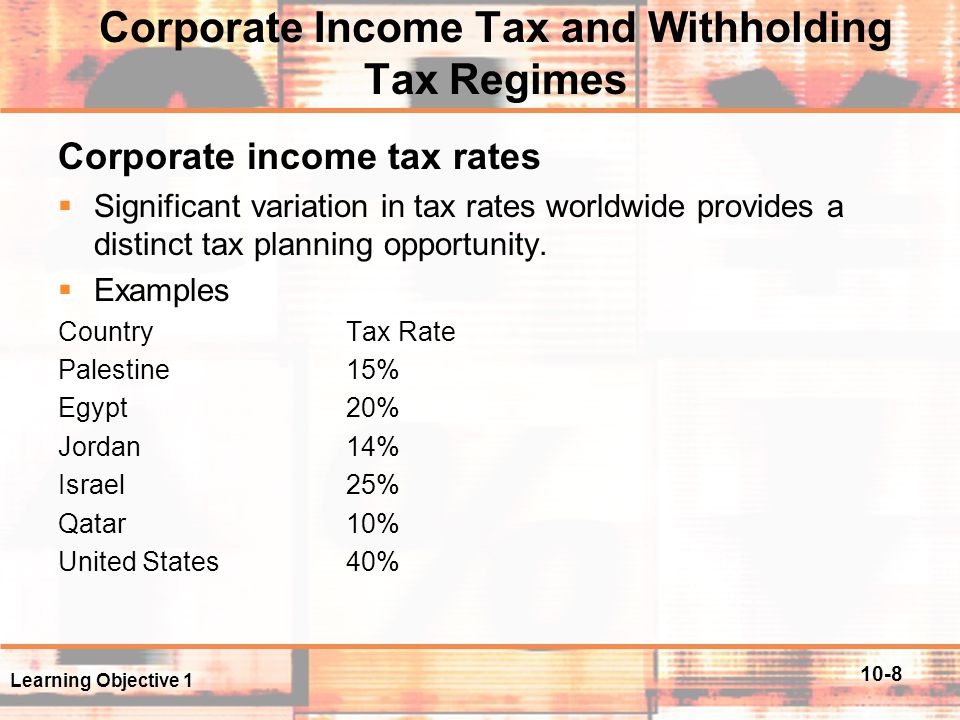

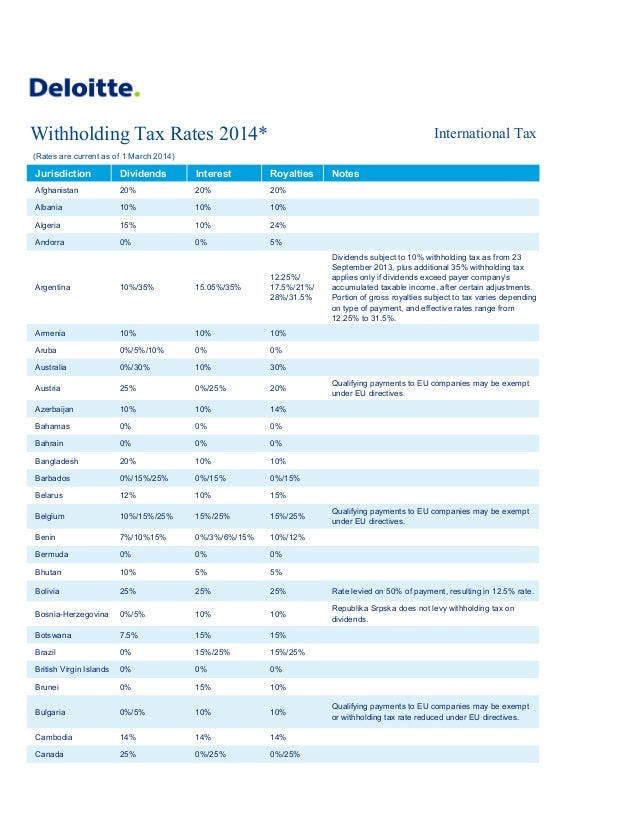

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

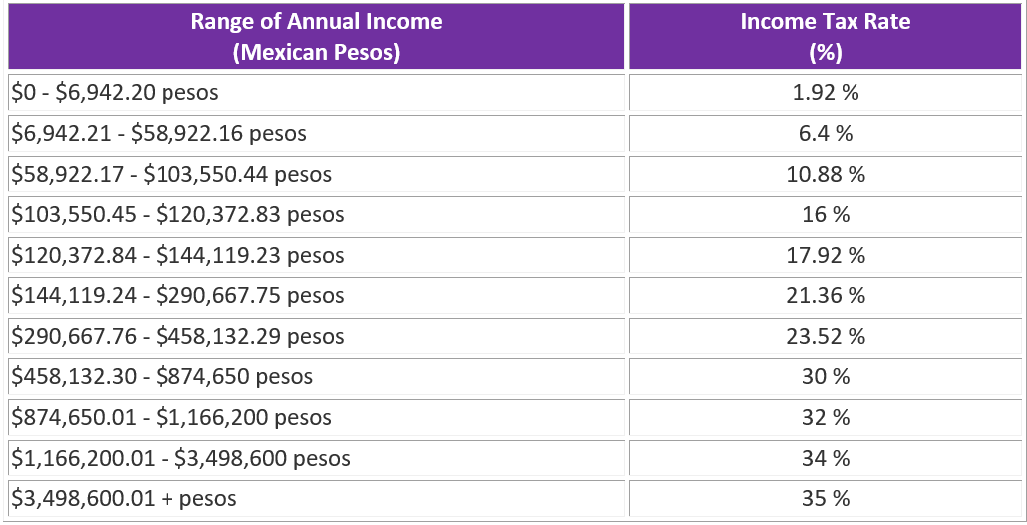

This tax rate is reached at an annual income of MXP300000001 monthly income of MXP25000001.

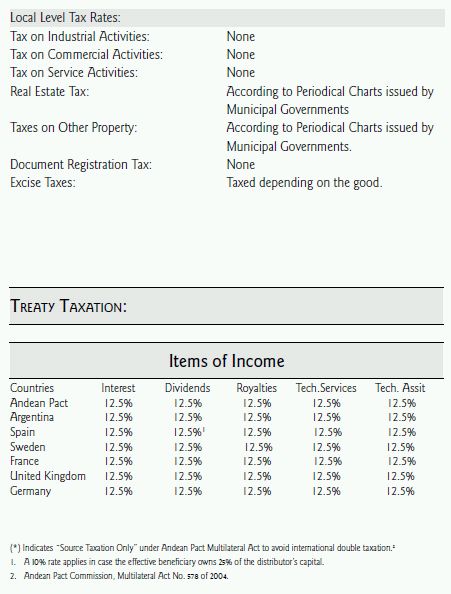

Withholding tax rates mexico. Applicable on the invested capital. Back-to-School Tax Holiday is this weekend. Tobaccocigarettes and related services tax the rate depends on the tobacco product.

Property Taxes In Mexico. Corporation Income Tax and Corporation Franchise Tax Bulletin B-20025 Withholding Tax on Owners of a Pass-Through Entity. And b That while Mexico imposes no excise tax on insurance premiums paid to foreign insurers and has no immediate plans to do so should Mexico enact such a tax in the future Mexico will waive such tax on insurance premiums paid to insurers resident in the United States.

Withholding tax WHT rates WHT rates DivIntRoy Resident. 265 percent 30 percent and 53 percent. Employers must keep accounting documents on record for five years after they were emitted.

There are three 3 types of tax that you will face for residential property involving the buying owning and selling process. Read a March 2021 report Spanish prepared by the KPMG member firm in Mexico. Regarding the withholding tax for taxpayers involved in the motor transport of passengers or cargo the rate is 75 of the base contribution salary.

304 percent and 160 percent. Otherwise residents are taxed at the normal income tax rate. 10 49 to 35 5 to 35 WHT on dividend paid to an individual.

Employers should refer to the New Mexico State Wage Withholding Tables located in the FYI-104 to determine the proper amount to withhold. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat ReaderFor further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The rate ranges between 1 and 3 percent.

If you buy real estate in Mexico you will have property taxes. Tax Policy Advisory Committee meets Wednesday. New Mexico Withholding Tax 404Error.

10 104 NA. 15 10 30 unless rates. The complete texts of the following tax treaty documents are available in Adobe PDF format.

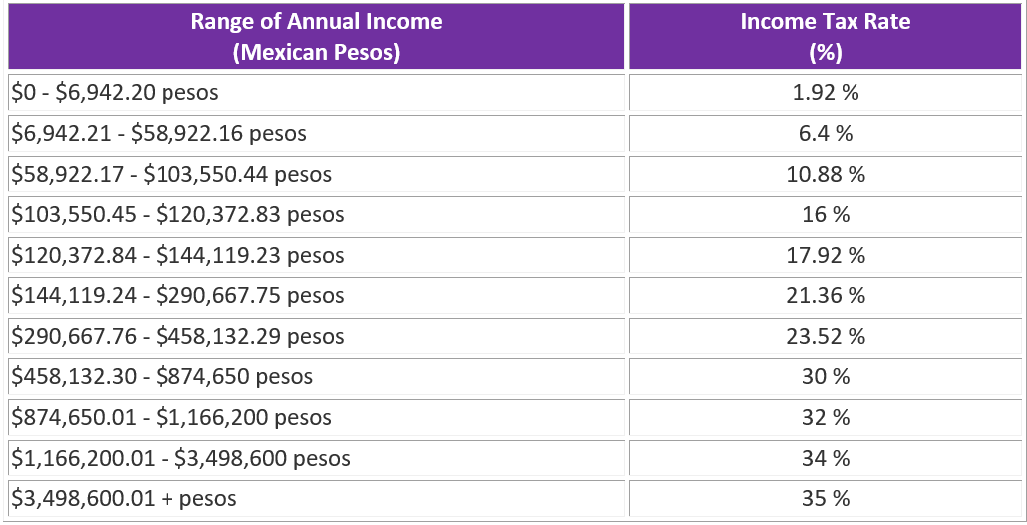

The following tax rates are effective for resident individuals for calendar year 2021. Rental income is subject to a 21 withholding tax if you rent out the property while residing outside of Mexico. 304 percent applies to handmade products only.

The income tax is determined by applying a graduated scale with a maximum marginal tax rate of 35 percent for tax year 2016. The amount of tax withheld may vary depending on how many allowances an employee claims on the federal W-4 form and how often wages are paid. Delivered groceries may not be taxable.

To comply with this obligation the distributing entity must withhold the value of the tax and file a return within 3 months after the end of the taxable year. Note that in Mexico dividends have an effective tax rate rounding 42. Employers should refer to the New Mexico State Wage Withholding Tables located in the FYI-104 to determine the proper amount to withhold.

New multi-year tax forms available. Manage your account online All Forms Publications FYI-350. Hearing scheduled on new rules for New Mexico drivers licenses.

Income taxes on certain income profit or gain from sources within the United States. The first MXN 125900 of employment income received in a 12-month floating period will be tax exempt. Agree to promptly amend the Convention to incorporate that lower rate.

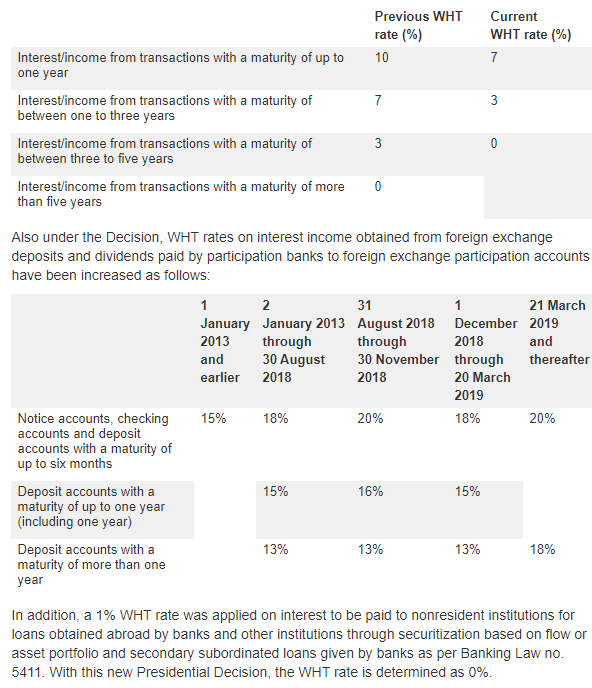

The tax rate applicable is 7 percent for the fiscal year 2020 and 13 percent as of FY 2021. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US. According to the Mexican Income Tax Act dividends are taxed with income tax both for the distributing legal entity and for the receiving shareholder.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. Alcoholic beverages tax and services related with them the rates depend on the percentage of alcohol and the type of beverage. Reporting Tax Withheld Income and withholding information returns are generally required to be reported to the Department by the last day of February.

There is payroll tax in Mexico which is levied at the state level. The tax year runs from 1st January to 31st December. WHT on interest paid by financial institutions.

Changes Coming to Combined Reporting System. Maquiladoras are foreign-owned companies in Mexico that are able to import machinery and materials duty free export finished products around the world and avoid permanent-establishment status for tax purposes. Dividends paid by a local entity to a local individual are subject to income tax withholding.

15 10 0 but VAT 19 unless exempted. Estimated tax payments and withholdings are credited to offset the final annual tax liability.

Managing Corporate Taxation In Latin American Countries Bolivia Tax Bolivia

Managing Corporate Taxation In Latin American Countries Bolivia Tax Bolivia

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Turkey Announces Change In Withholding Tax Rates On Interest Obtained From Deposits Issued Abroad And Foreign Exchange Deposits Ey Global

Turkey Announces Change In Withholding Tax Rates On Interest Obtained From Deposits Issued Abroad And Foreign Exchange Deposits Ey Global

Panama Tax Treaties Tax Panama

Panama Tax Treaties Tax Panama

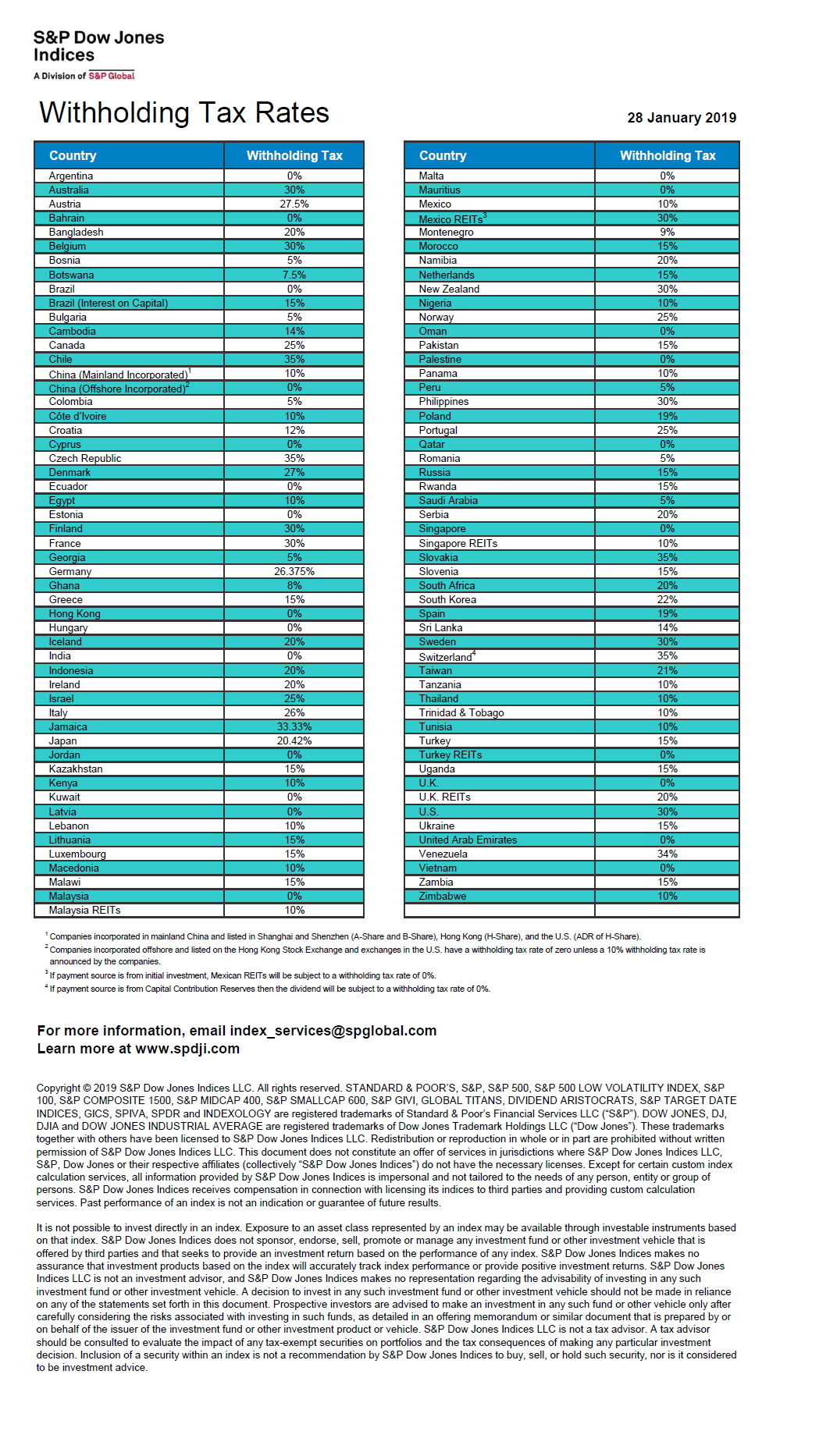

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Withholding Tax For Sales Sap Blogs

Withholding Tax For Sales Sap Blogs

Mexico 2020 Tax Reforms White Case Llp

Mexico 2020 Tax Reforms White Case Llp

A Guide To Taxes And Taxation In Mexico Vtz Law Firmvtz

A Guide To Taxes And Taxation In Mexico Vtz Law Firmvtz

Dividend Withholding Tax Rates By Country Rating Walls

Dividend Withholding Tax Rates By Country Rating Walls

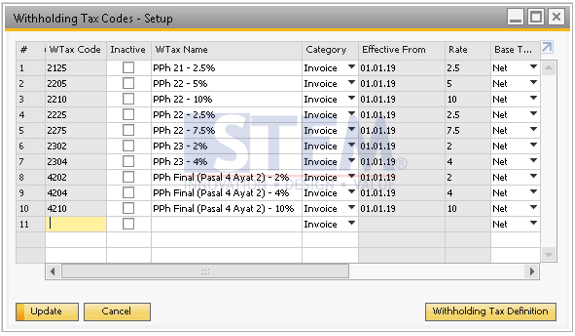

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Understanding Dividend Withholding Tax In Mexico For Us Residents Biz Latin Hub

Understanding Dividend Withholding Tax In Mexico For Us Residents Biz Latin Hub

Mexico Global Payroll Tax Information Guide Payslip

Mexico Global Payroll Tax Information Guide Payslip

International Taxation Ppt Download

International Taxation Ppt Download

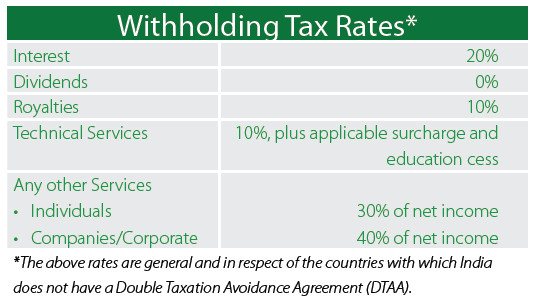

Withholding Tax Rates In India Dezan Shira Associates

Withholding Tax Rates In India Dezan Shira Associates

General Information On The Brazilian Tax System Bpc Partners

General Information On The Brazilian Tax System Bpc Partners

Post a Comment for "Withholding Tax Rates Mexico"