Employment Law Withholding Wages Uk

This is completely different from a deliberate decision on the employers part to. Theres a shortfall of 50 in your till and your employer wants to deduct this from your earnings.

Can I Sue My Employer For Not Paying Me Wage Violations

Can I Sue My Employer For Not Paying Me Wage Violations

Can an employer withhold pay from their employees.

Employment law withholding wages uk. This includes holiday days commission and any pre-agreed bonuses. Why are employees given payslips. The Living Wage 872 per hour as of April 2020 applies to all workers aged over 25 while the lower National Minimum Wage has several categories dependent on age.

Income tax withholding schedules provide graduated tax rates to be withheld by employers each pay period giving considerations to a wage earners marital status and the number of withholding allowances claimed. You should always seek advice and be aware of your rights before making deductions from wages. Such circumstances may involve breaching the employment contract.

Where the employer withholds wages other than in the circumstances above an employee or worker has the right to make a claim in a tribunal for unlawful deduction from wages. But statutory authorisation is an example where you can deductwithhold wages lawfully. An employer must pay employees all wages due at least two 2 times per calendar month on regular paydays designated in advance by the employer.

Youre paid 250 gross per week. For example if on 1 February the employer miscalculated the employees wages and overpaid him by 500 the employer is entitled to deduct that 500 from his next pay packet. The Employment Rights Act of 1996 confirms that employees receive full payment of their wages.

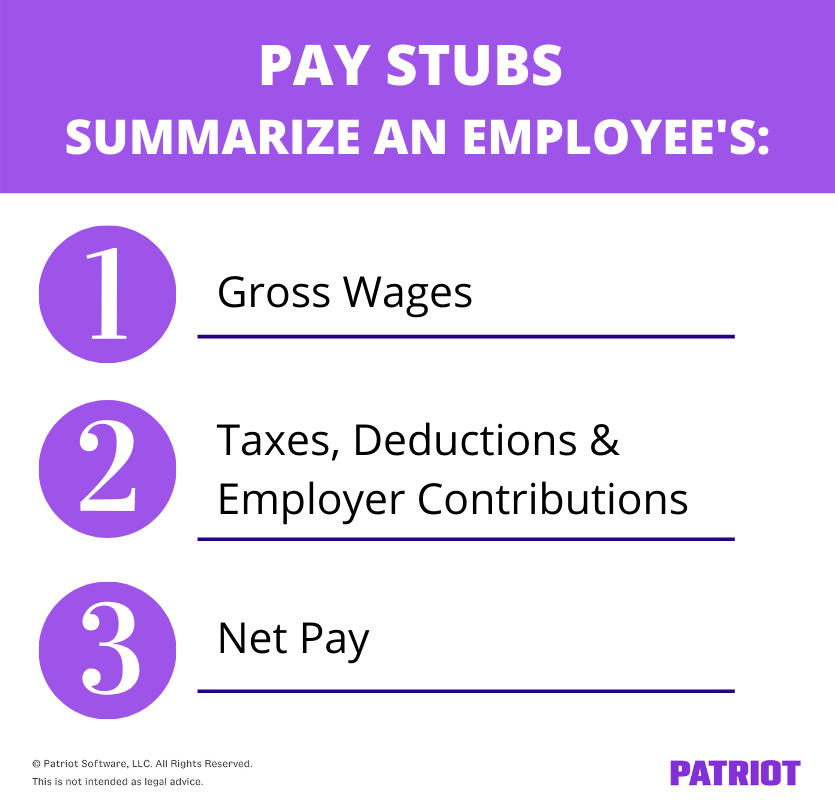

In the UK Payslip Law is addressed in the Payment of Wages Act 1991. Keep reading to learn more about when an employer has the right to withhold money from their employees. If you leave employment they are then allowed to deduct the full outstanding amount from your last paycheck.

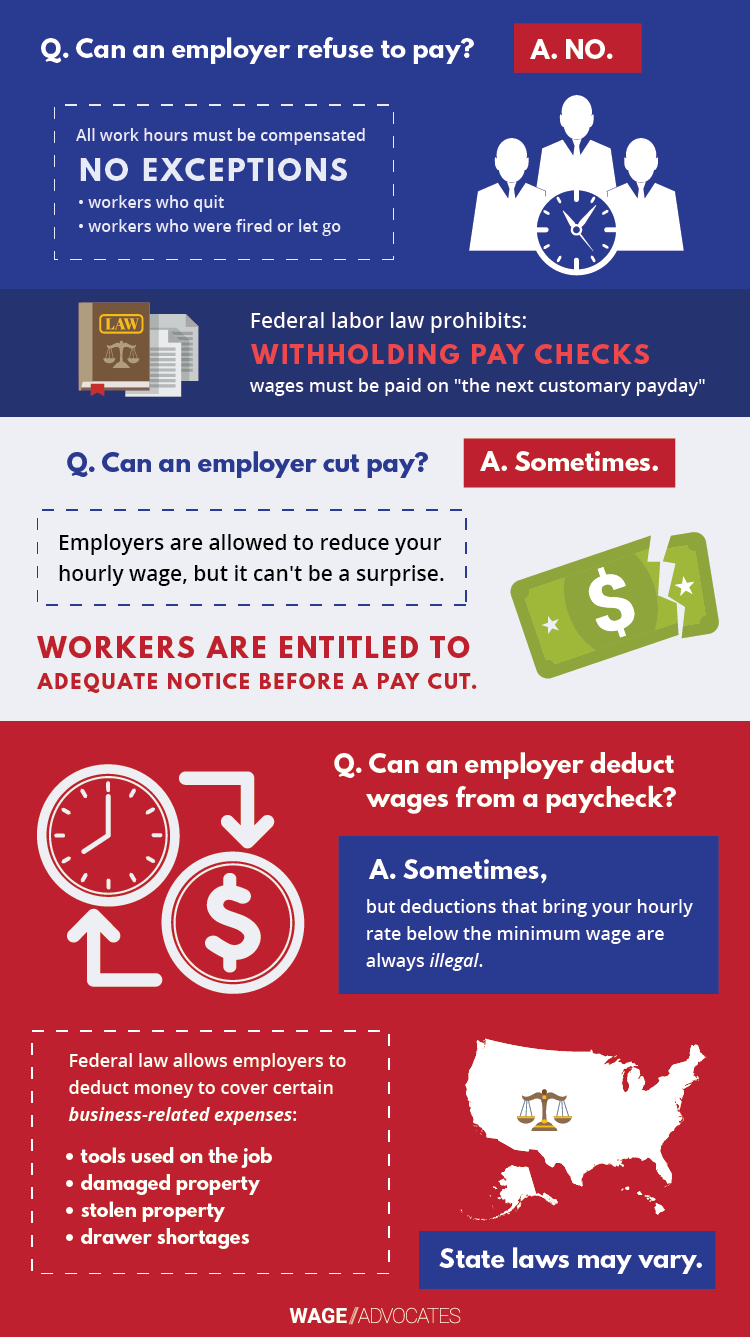

Theres a written agreement with your employer saying they can take money. These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions. An employer can only withhold money from an employee under specific circumstances.

Your employer can take 10 of your gross earnings which is 25. Fundamentally a payslip is a written statement from your employer that shows what you earn before tax as well as any deductions. You dont lose any more than 10 of your pay before tax on each payday the deduction is made.

This Act grants all employees the right to a payslip and outlines what should be included in a payslip. For more information please contact our team. An unlawful deduction of wages claim is brought in the Employment Tribunal and as there are no issue fees to pay it is free for an employee to challenge their wage even whilst still in employment with you.

Frequency of Wage Payments. There are however a few other exceptions to this rule. This is where you make reductions for National Insurance payments and income tax.

A tribunal or court might have ordered you to repay an employer a certain amount and the employer can then make appropriate deductions from your wages. If you work in a shop bar or restaurant you can have money taken from your wages to cover missing money from the till or damaged stock as long as. However a single breach does not normally justify resignation and a claim for constructive dismissal.

The minimum wage UK workers are entitled to is regulated by the National Minimum Wage and the Living Wage - the rates of which change every April. Wages are protected in usual contexts the term wages can include commissions in the Employment Rights Act and employers can only withhold wages in very limited circumstances. For example an employer may withhold a paycheck that is fail to issue a paycheck to an employee altogether.

Technically speaking if an employee is working as per their contract of employment a failure to pay wages would be in breach of contract and so an unlawful deduction from wages. Your employer will not have broken the law if the deduction was purely an error as sometimes happens when computer systems make a mistake and underpay employees. Does withholding wages count as a breach of employment contract.

As the law currently stands if you work in a restaurant your employer cannot count any tips you receive as part of your wages for the purpose of the National Minimum Wage. State county and municipal employees exempt employees and employees of qualifying non-private foundations must at least one 1 time per calendar month. 1 An employer shall not make a deduction from wages of a worker employed by him unless a the deduction is required or authorised to be made by virtue of a statutory provision or a relevant.

The withholding of salary occurs when an employer fails to pay an employee the wages or salary they have promised to pay for the work done by the employee.

Wage Increase Form Inspirational 10 Best Of Employee Wage Agreement Form Salary Repayment Salary List Of Jobs

Wage Increase Form Inspirational 10 Best Of Employee Wage Agreement Form Salary Repayment Salary List Of Jobs

Calif Final Paycheck Law What S The Penalty If They Pay Me Late

Calif Final Paycheck Law What S The Penalty If They Pay Me Late

How To Report Unpaid Wages And Recover Back Pay Findlaw

How To Report Unpaid Wages And Recover Back Pay Findlaw

National Minimum Wage Economics Online Economics Online

National Minimum Wage Economics Online Economics Online

Can An Employer Withhold A Paycheck Ricotta Marks P C

Can An Employer Withhold A Paycheck Ricotta Marks P C

Last Paycheck Laws When Do I Get A Paycheck After Leaving A Job Findlaw

Last Paycheck Laws When Do I Get A Paycheck After Leaving A Job Findlaw

Pay Stub Requirements By State Overview Chart Infographic

Pay Stub Requirements By State Overview Chart Infographic

When Can An Employer Withhold Wages Birkett Long Solicitors

When Can An Employer Withhold Wages Birkett Long Solicitors

Wage And Hour Is It Legal To Suspend An Employee Without Pay As A Form Of Discipline Hr Daily Advisor

Wage And Hour Is It Legal To Suspend An Employee Without Pay As A Form Of Discipline Hr Daily Advisor

What Are Gross Wages Definition And Overview

What Are Gross Wages Definition And Overview

7 Paycheck Laws Your Boss Could Be Breaking Fortune

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Payroll Management System Payroll Management Software

Payroll Management System Payroll Management Software

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Overtime Pay Laws Every Business Owner Needs To Know Bookkeeping Business Business Management Business Basics

Overtime Pay Laws Every Business Owner Needs To Know Bookkeeping Business Business Management Business Basics

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

Paying Employees Overseas International Payroll Iris Fmp

Paying Employees Overseas International Payroll Iris Fmp

6 Ways To Split Tips Between Employees Buzztime

6 Ways To Split Tips Between Employees Buzztime

Overpayment Of Wages What To Do If An Employee Is Overpaid Natural Hr

Overpayment Of Wages What To Do If An Employee Is Overpaid Natural Hr

Hr Employment Law Level 2 Employment Law Employment Human Resource Management

Hr Employment Law Level 2 Employment Law Employment Human Resource Management

Post a Comment for "Employment Law Withholding Wages Uk"