How Much Tax Do I Pay If I Am Self Employed Uk

Self-employed individuals generally must pay self-employment tax SE tax as well as income tax. Find out more about Scottish Income Tax and National Insurance.

How To Tell If You Are Self Employed Taxact Blog

How To Tell If You Are Self Employed Taxact Blog

If she lives in England Wales or Northern Ireland she pays income tax at the Basic Rate of 20 on the 1500 of her pay that is above the allowance for her main job and on all her income from her second job.

How much tax do i pay if i am self employed uk. Usually a self-employed person can start in business without following any formal or legal set up tasks. The self-employment tax is a social security and Medicare tax on net earnings from self-employment. But since self-employed people dont have employers you have to pay the entire 153 amount from your profits which are defined as your net earnings less.

Use the self-employed ready reckoner to budget for your Self Assessment tax bill for the 2021 to 2022 tax year. If youre self-employed you use your individual IRD number to pay tax. Self Employed Tax Calculator 2021-2022.

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Working from home - allowances for the self-employed updated for 2122 This article was published on 03082020 Self-employed guide to claiming allowances for working at home. Enter your estimated weekly or monthly profit to get an idea of how much Income Tax.

Tax will be taken at source if for example you are also employed as well as self-employed through Pay As You Earn PAYE. If you start working for yourself youre classed as a sole trader. Yes most self-employed people pay Class 2 NICs if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year.

For 202021 there are different income tax rates for Scottish residents. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year. You must pay self-employment tax if your net earnings from self.

Firstly if your self-employed profits exceed 6475 youll have to pay a flat rate of 305 per week. You pay 7200 40 on your self-employment income between 10000 and 28000. This means youre self-employed - even if you havent yet told HM Revenue and Customs HMRCRunning a business.

Self-employment includes contracting working as a sole trader and small business owners. See what happens when you are both employed and self employed at the same time - with UK income tax National Insurance student loan and pension deductions. Estimated VAT taxable turnover for next 12 months is 150000 excluding VAT or less.

The self-employment tax rate is 153. You will need to pay Class 2 NI worth 159. Self-employment tax applies to.

More information about the calculations performed is available on the details page. In this article well dig deeper and focus on the deadlines and what it is you need to pay. As a self-employed individual generally you are required to file an annual return and pay estimated tax quarterly.

The key difference is in two areas National Insurance Contributions and the ability to deduct expenses and costs before calculating any deductions. You pay 2000 20 on your self-employment income between 0 and 10000. An extra charge of 3 applies to any self-employed income over 100000 regardless of age.

That rate is the sum of a 124 for Social Security and 29 for Medicare. This means that self-employed people pay a total of 11 USC on any income over 100000. If you are self-employed and work from home understanding and calculating the expenses youre allowed to.

Pay VAT based on a fixed percentage of your sales the percentage used depends on the type of business ran and you may also have to consider the amount of business expenditure incurred on relevant goods. Other income that sole traders receive in addition to business profits will need taxing separately. Here is the Ultimate Guide for Self Employed Tax UK.

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. You will also have to pay 900 9 on 10000 of your self-employment income. The USC does not apply to social welfare or similar payments.

You pay tax on net profit by filing an individual income return. Income Tax is different in Scotland. This is called Class 2 National Insurance these figures are.

Self employment profits are subject to the same income taxes as those taken from employed people. You normally have to make a payment on account if your previous years bill excluding Class 2 NIC was over 1000 unless more than 80 of your previous years tax was taken off at source. Employed and Self Employed uses tax information from the tax year 2021 2022 to show you take-home pay.

In general anytime the wording self-employment tax.

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Self Declaration Of Income Letter Beautiful Proof In E Letter Self Employed Sample Templatex Samples Lettering Letter Templates Letter Of Employment

Self Declaration Of Income Letter Beautiful Proof In E Letter Self Employed Sample Templatex Samples Lettering Letter Templates Letter Of Employment

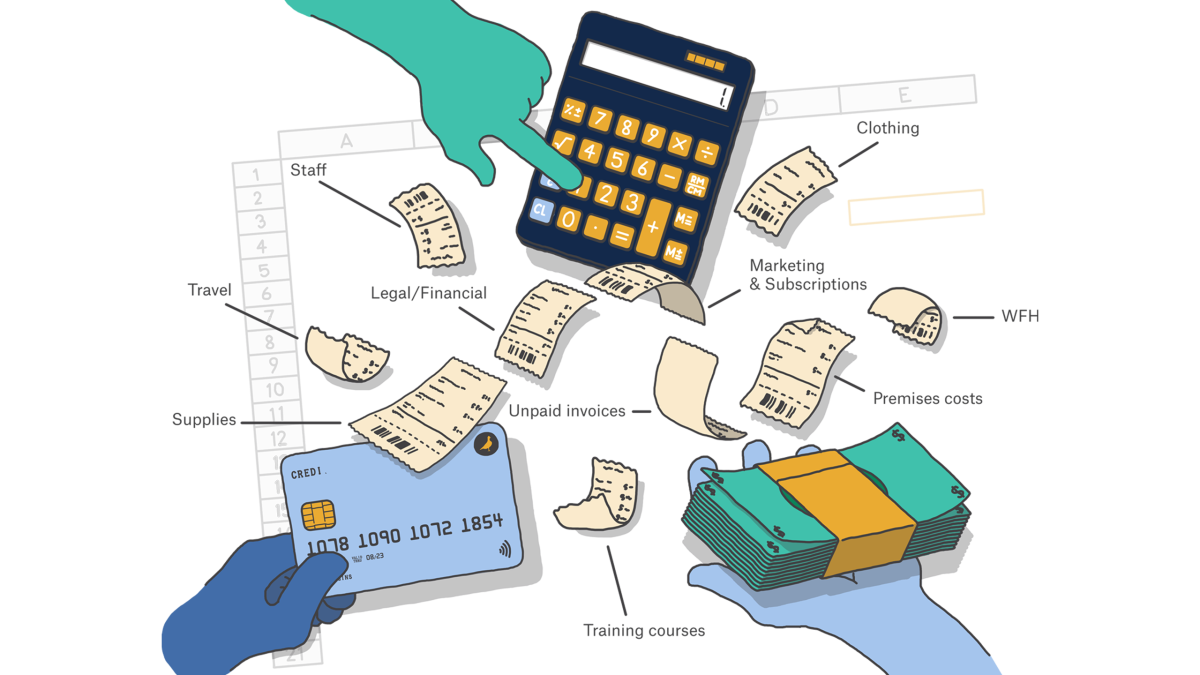

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Self Employed Tax For Non Geeks In 2020 Small Business Uk Small Business Finance Business Blog

Self Employed Tax For Non Geeks In 2020 Small Business Uk Small Business Finance Business Blog

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Best Free And Simple Templates

Self Employed Invoice Template Best Free And Simple Templates

All The Key Self Employment Tax Dates For 2019 Goselfemployed Co Help And Tips For Self Empl Small Business Bookkeeping Employment Application Business Tax

All The Key Self Employment Tax Dates For 2019 Goselfemployed Co Help And Tips For Self Empl Small Business Bookkeeping Employment Application Business Tax

Self Employed Invoice Template Pdf Templates Jotform

Self Employed Invoice Template Pdf Templates Jotform

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed In The Uk A Simple Guide

The Top 10 Best Self Employed Jobs Smartasset

The Top 10 Best Self Employed Jobs Smartasset

Tips For Buying A Home If You Re Self Employed Nfm Lending Apply For A Loan Mortgage Banker Self

Tips For Buying A Home If You Re Self Employed Nfm Lending Apply For A Loan Mortgage Banker Self

Freelance Tax In Spain For Self Employed Expats Expatica

Freelance Tax In Spain For Self Employed Expats Expatica

2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas

2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas

A Guide To Going Self Employed With Your Blog Samantha J Going Self Employed Blog Earnings Self

A Guide To Going Self Employed With Your Blog Samantha J Going Self Employed Blog Earnings Self

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

2017 Self Employment Tax Form Inspirational 30 Beautiful 2017 Self Employment Tax And Deduction Worksheet Models Form Ideas

2017 Self Employment Tax Form Inspirational 30 Beautiful 2017 Self Employment Tax And Deduction Worksheet Models Form Ideas

Post a Comment for "How Much Tax Do I Pay If I Am Self Employed Uk"