Withholding Tax Rates Under Dtaa

Below is a list of countries that have a comprehensive DTAA with India. Congo Republic of Last reviewed 13 January 2021 Resident.

Filing Taxes On H1b Visa The Ultimate Guide

The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US.

Withholding tax rates under dtaa. The person responsible for making. A DTAA between India and other countries covers only residents of India and residents of the negotiating country. Income taxes on certain income profit or gain from sources within the United States.

91 rows Country-wise Withholding tax ratesChart as per DTAA. A Rate of tax shall be 10 on income from Global Depository Receipts under Section 115AC1b of Income-tax Act 1961. 10 if loan is granted by a banksimilar institute including insurance company.

Under the Mauritius-India Double Tax Avoidance Agreement DTAA an Indian company paying dividends to a Mauritius entity has to withhold tax at source at a preferential rate of either 5 or 15 subject to the Mauritius company being the beneficial owner of the dividends tax resident in Mauritius and fulfilling the limitation of benefits clause. 5182018 Income Tax Department aboutblank 6 7 b 125 in other cases United Mexican States 10 10 Note1 10 10 United Kingdom 1510 Note 4 a 10 if interest is paid to a bank. Congo Democratic Republic of the Last reviewed 11 March 2021 Resident.

Withholding tax rates under Indias DTAAs. The 15 rate applies in other cases. After 31 May 1997 but before 1.

102 of the India-Netherlands Double Taxation Avoidance Agreement DTAA India is in principle allowed to levy 15 1 of the gross amount of the dividends distributed to a Dutch company. After 31 March 1976 but before 1 June 1997. B Rate of tax shall be 20 under Section 115A on dividend other than dividends referred to in section 115-O received by a.

20 in other cases. B Rate of tax shall be 20 under Section 115A on dividend received by a foreign company or a non-resident non-corporate assessee. 15 0 0.

Any person or a company that is not resident either in India or in the other country that has entered into an agreement with India cannot claim benefits under the signed DTAA. Withholding tax rates under DTAA. C Rate of tax shall be 20 under Section 115AD on dividend received by a Foreign institutional investor.

Following is the list of countries with which India has limited agreements. Hence if the DTAA rate is 10 Act rate is 15 and the payee does not have a PAN the tax withholding rate would be 20 higher rate. The 5 rate applies if the beneficial owner of the dividends is a company other than a partnership that directly holds at least 10 of the capital of the payer company.

20 20 See the Withholding taxes section of Colombias corporate tax summary. A Rate of tax shall be 10 on income from Global Depository Receipts under Section 115AC1b of Income-tax Act 1961 other than dividends referred to in section 115-O. Ordinarily in terms of Section 206AA of the IT Act if a person entitled to receive any income on which withholding tax is deductible does not furnish a Permanent Account Number PAN to the person responsible for deducting such tax in such case the tax is.

However this provision is now relaxed and if the non resident is able to furnish the tax residency certificate then the beneficial rate can be applied and the 20 higher rate tax deduction can be avoided. 39 rows A person responsible for making payment to non-resident or foreign company is required to withhold. 10 or 20 0 or 20 20.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. 10 or 20 0 20. B 15 in other cases Note1 1015Note 2 1015 Note 2 United States a 15 if at least 10 of the voting stock of the company.

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. Between 1 and 20 Non-resident. 15 20 20.

95 rows Tax Rate. 15 if at least 10 of the voting stock of the company paying the dividend is held by the recipient.

Russia S Double Tax Treaty Agreements Russia Briefing News

Russia S Double Tax Treaty Agreements Russia Briefing News

Finance Act 2012 Brought In Specified Domestic Transactions Within The Transfer Pricing Provision Under Income Tax Ac Taxact Transfer Pricing Capital Gains Tax

Finance Act 2012 Brought In Specified Domestic Transactions Within The Transfer Pricing Provision Under Income Tax Ac Taxact Transfer Pricing Capital Gains Tax

India S Dtaa Dezan Shira Associates

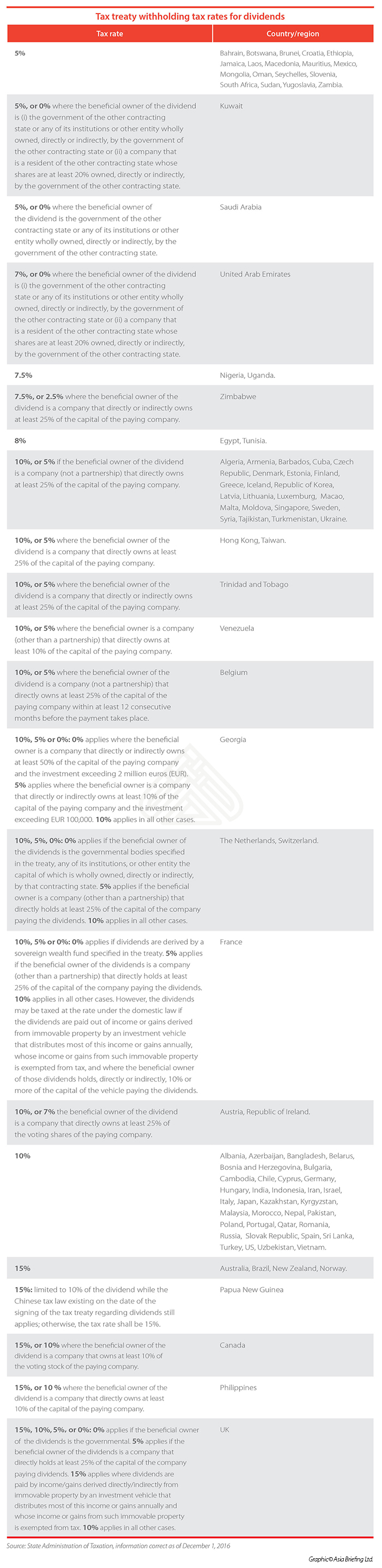

Understanding China S Double Tax Agreements China Briefing News

Understanding China S Double Tax Agreements China Briefing News

Income Tax Android App As Ready Reckoner Youtube Tax App Income Tax App

Income Tax Android App As Ready Reckoner Youtube Tax App Income Tax App

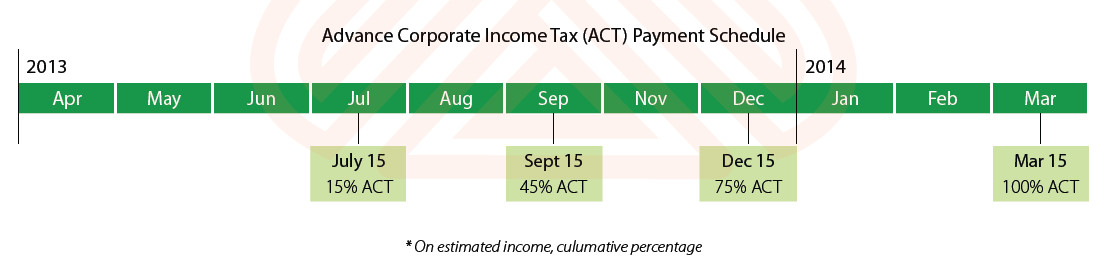

Infographic Page 53 Asiapedia Business Resource Library Dezan Shira Associates

Infographic Page 53 Asiapedia Business Resource Library Dezan Shira Associates

Withholding Tax In China China Briefing News

Withholding Tax In China China Briefing News

4 Reasons Why Debt Fund Is Still Better Than Fixed Deposits Http Taxworry Com 4 Reasons Debt Fund Still Better Fixed Dep Capital Gains Tax Investing Taxact

4 Reasons Why Debt Fund Is Still Better Than Fixed Deposits Http Taxworry Com 4 Reasons Debt Fund Still Better Fixed Dep Capital Gains Tax Investing Taxact

German Law Removes Us S Corporation Tax Benefit

Panama Tax Treaties Tax Panama

Panama Tax Treaties Tax Panama

Tax Treaties Database Global Tax Treaty Information Ibfd

Tax Treaties Database Global Tax Treaty Information Ibfd

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

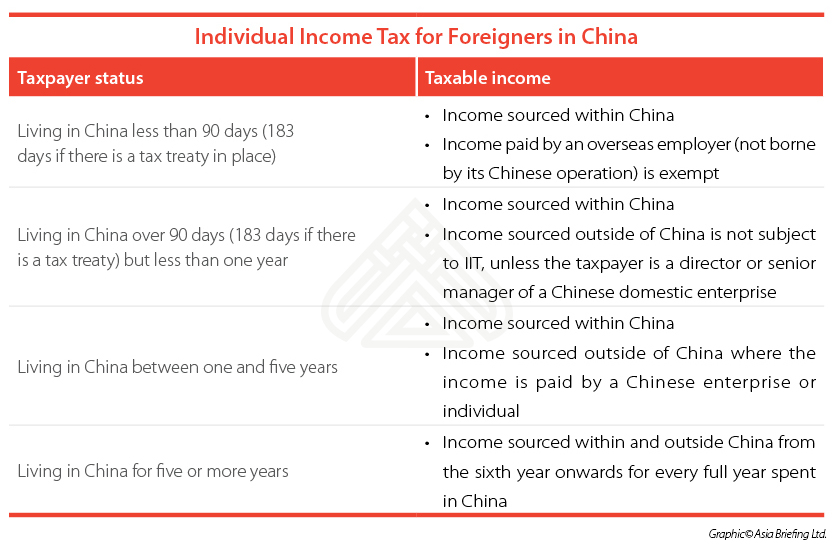

Paying Foreign Employees In China Individual Income Tax China Briefing News

Paying Foreign Employees In China Individual Income Tax China Briefing News

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Freelance Capital Gains Tax

Why Freelancers From India Working For Foreign Clients Online May Not Be Liable For Service Tax Taxworry Com Tax Freelance Capital Gains Tax

International Tax Treaty The United Kingdom Freeman Law Jdsupra

International Tax Treaty The United Kingdom Freeman Law Jdsupra

5 Ways You Can Acquire Status Of Assessee In Default Why It Is So Dangerous Http Taxworry Com 5 Ways Can Acqu Capital Gains Tax Taxact Transfer Pricing

5 Ways You Can Acquire Status Of Assessee In Default Why It Is So Dangerous Http Taxworry Com 5 Ways Can Acqu Capital Gains Tax Taxact Transfer Pricing

Fpis Stare At Higher Withholding Tax On Dividends Owing To Tax Treaty Business Standard News

Fpis Stare At Higher Withholding Tax On Dividends Owing To Tax Treaty Business Standard News

Post a Comment for "Withholding Tax Rates Under Dtaa"