Self Employment Guide For Universal Credit

However DWP were concerned that this would allow both employed and self-employed UC claimants the ability to change their earnings patterns to increase their UC awards. Self employment and benefits - Universal Credit and self employment If you or your partner are working or thinking of starting work as a self employed person you might qualify for welfare benefits to top up your income.

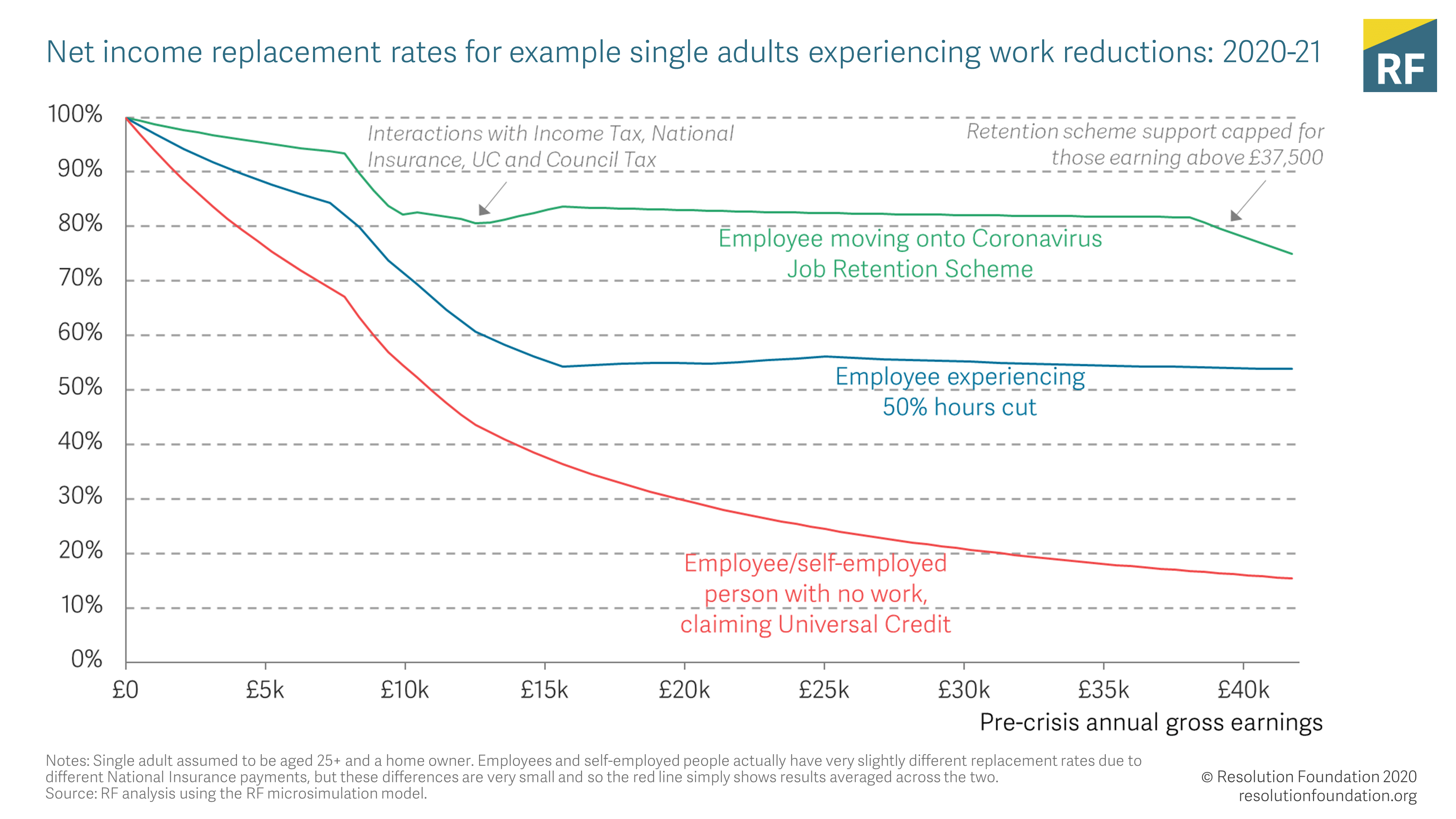

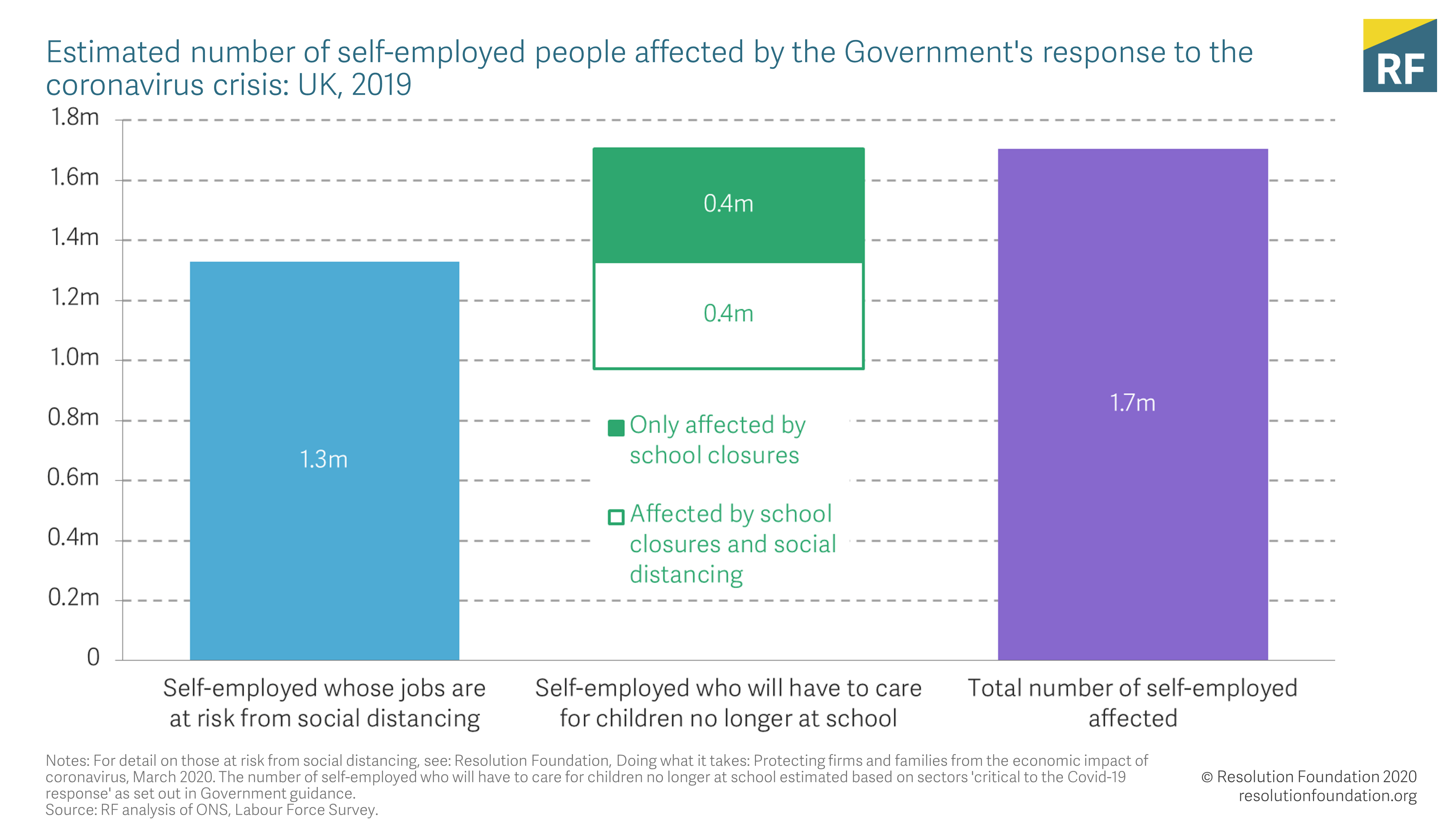

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

If you are self-employed and make a claim for Universal Credit and are required to look for work in order to claim Universal Credit you will be invited to a Gateway Interview to.

Self employment guide for universal credit. New claimants do not need to attend the jobcentre to demonstrate gainful. If youve been gainfully self-employed for less than 12 months you may be classed as being in the start up period and the minimum income floor wont apply for. When completing their self-assessment tax returns Universal Credit claimants.

Self Employment and Universal Credit This section is a Universal Credit self-employment guide for people who work for themselves. Self-employed Universal Credit claimants must use the same accounting basis. If you are self-employed and claiming Universal Credit its important that you let DWP know about your income so that your Universal Credit payment can be processed.

If you are regarded as being gainfully self-employed whilst claiming Universal. Your payments will be affected by something called the minimum income floor. If you move onto Universal Credit and have been gainfully self-employed for 12 months or more the minimum income floor will apply to your earnings.

It describes what will be. Universal Credit includes a Minimum Income Floor MIF if you are gainfully self-employed and your business has been running for more than 12 months. It explains how to claim Universal Credit when self-employed and how to report your earnings.

To calculate your self-employed earnings for Universal Credit you will need to add all of your income for the assessment period - called receipts - and minus the amount you have spent on your business - called personal allowances and permitted expenses. If you are self employed you will have to supply monthly cash-in and cash-out figures to the Department for Work and Pensions DWP. The amount you get will also depend on other factors such as whether youre in a couple or have children.

Proof of self-employed earnings. Self-employed peoples Universal Credit payments fluctuate with their income. How much youll get.

For example an employee could agree with their employer to be paid all of their salary in month 1 followed by no payments for the next 11 months and so a maximum award of UC paid in those 11 months and then repeat that in the. Youll have to report earnings for each month the DWP calculate your Universal Credit payments - this is called an assessment period. If you are gainfully self-employed.

This includes reporting if. Self-employment During the coronavirus outbreak. Universal Credit and self employment Self-employed people can get Universal Credit if their income and capital are low enough.

In most cases Universal Credit is a monthly benefit payment paid out to help with living costs. This guide is to help you understand what you need to do if you have self-employed earnings and are claiming Universal Credit. During your time on Universal Credit you and your work coach will agree on the steps you need to take to prepare for work now or in the future and you may be referred to one or more of these.

If you fail to supply these figures between seven days before and 14 days after each month your Universal Credit payment will be suspended. Universal Credit claimants must leave the cash basis if their annual turnover is greater than 154000 twice the VAT registration limit Transitional rules There are no transitional rules. This guide explains what Universal Credit means for claimants who own their own business or would like to do so.

Your Universal Credit payment will be calculated based on your combined earnings from self-employment and employment. If you make a loss from self-employment only your employment earnings will be. Self-employed capital Calculating income from self-employment for UC is very different to tax credits where claimants simply take the figure used for their tax return for the appropriate tax year and enter it on to the tax credits forms.

This includes if you combine self-employment with other work are a. Your assessment period usually starts on the same date each month - starting 1 calendar month after the date you submit your claim online or over the phone.

Self Employed Maternity Pay A Guide For Freelancers And Sme Owners

Self Employed Maternity Pay A Guide For Freelancers And Sme Owners

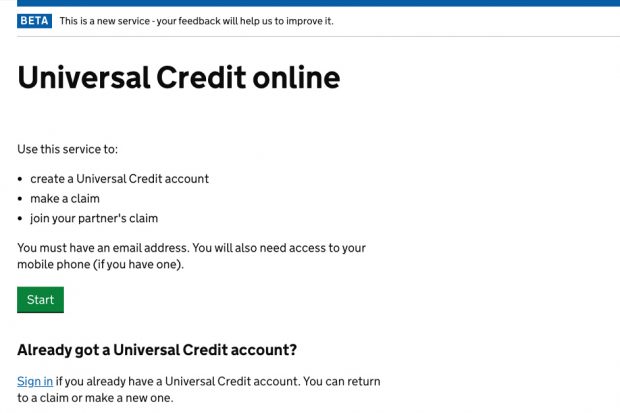

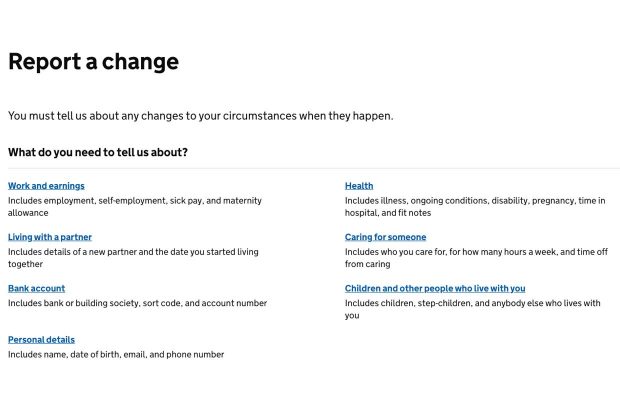

How We Design Content For The Universal Credit Digital Service Dwp Digital

How We Design Content For The Universal Credit Digital Service Dwp Digital

Your Income And Coronavirus Covid 19 Policy In Practice

Your Income And Coronavirus Covid 19 Policy In Practice

The Minimum Income Floor In Universal Credit What Is It And When Does It Apply By Josh Gilbert Adviser Online Medium

The Minimum Income Floor In Universal Credit What Is It And When Does It Apply By Josh Gilbert Adviser Online Medium

Disability Benefits Crohn S Colitis Uk

Disability Benefits Crohn S Colitis Uk

Frequently Asked Questions Understanding Universal Credit

Frequently Asked Questions Understanding Universal Credit

Resources For Families Small Businesses During The Coronavirus Outbreak Representative Cynthia Axne

Resources For Families Small Businesses During The Coronavirus Outbreak Representative Cynthia Axne

How Do Benefits And Sick Pay Work If You Are Self Employed Times Money Mentor

How Do Benefits And Sick Pay Work If You Are Self Employed Times Money Mentor

Guide To Sick Pay For Self Employed Business Owners Freeagent

Guide To Sick Pay For Self Employed Business Owners Freeagent

Yes You Can Take A Vacation When You Re Self Employed Here S How To Do It

Yes You Can Take A Vacation When You Re Self Employed Here S How To Do It

Covid 19 How To Claim A Grant Through The Coronavirus Self Employment Income Support Scheme Friends Families And Travellers

Covid 19 How To Claim A Grant Through The Coronavirus Self Employment Income Support Scheme Friends Families And Travellers

Universal Credit Could Leave Low Income Self Employed Workers 2 000 A Year Worse Off Than Regular Employees With The Universal Credit Tax Credits Filing Taxes

Universal Credit Could Leave Low Income Self Employed Workers 2 000 A Year Worse Off Than Regular Employees With The Universal Credit Tax Credits Filing Taxes

Top 7 Tips For Claiming Disability Benefits With M E Solve Me Cfs Initiative

Top 7 Tips For Claiming Disability Benefits With M E Solve Me Cfs Initiative

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Coronavirus Self Employment And Paying Tax Low Incomes Tax Reform Group

Coronavirus Self Employment And Paying Tax Low Incomes Tax Reform Group

How We Design Content For The Universal Credit Digital Service Dwp Digital

How We Design Content For The Universal Credit Digital Service Dwp Digital

Self Employed Maternity Pay A Guide For Freelancers And Sme Owners

Self Employed Maternity Pay A Guide For Freelancers And Sme Owners

.jpg)

Post a Comment for "Self Employment Guide For Universal Credit"