Unemployment Benefits Tax Break

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free.

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

The unemployment benefits that many taxpayers received for months are tax-free up to 10200.

Unemployment benefits tax break. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially. The IRS will then adjust returns for. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person collected in 2020. TurboTax and HR Block updated their online software to account for a new tax break on unemployment benefits received in 2020. After that point unemployment benefits are taxable income.

The American Rescue Plan a 19 trillion Covid relief bill signed. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Sarah TewCNET A 10200 tax exemption was added into the details of the American Rescue Plan for those who received unemployment benefits in.

The tax break isnt available to those who earned 150000 or more. 10200 Unemployment Tax Break A last minute addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from federal income tax. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes.

Unemployed workers could get more money from the IRS. However with the new stimulus bill up to 10200 in last years unemployment payments can be exempt from taxes if your adjusted gross income AGI is less than 150000 according to new. The benefit only applies to.

Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. In other tax developments were hearing more buzz about how the IRS might handle income tax refunds relating to a new tax break for a portion of unemployment benefits. The American Rescue Plan a.

The 19 trillion Covid relief. Key Points Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. More on jobless benefits.

The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. Federal law allows any recipient to choose to have a flat 10 withheld from their benefits to cover part or all of their tax liability. The 19 trillion American Rescue Plan allows those who received unemployment benefits to deduct 10200 in payments from their 2020 income.

The agency will start with taxpayers eligible for a break on up 10200 of unemployment benefits.

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Update Irs To Recalculate Taxes On Unemployment Benefits Refunds To Start In May Wpxi

Stimulus Update Irs To Recalculate Taxes On Unemployment Benefits Refunds To Start In May Wpxi

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

The Irs Just Made More People Eligible For An Unemployment Benefit Tax Break

The Irs Just Made More People Eligible For An Unemployment Benefit Tax Break

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

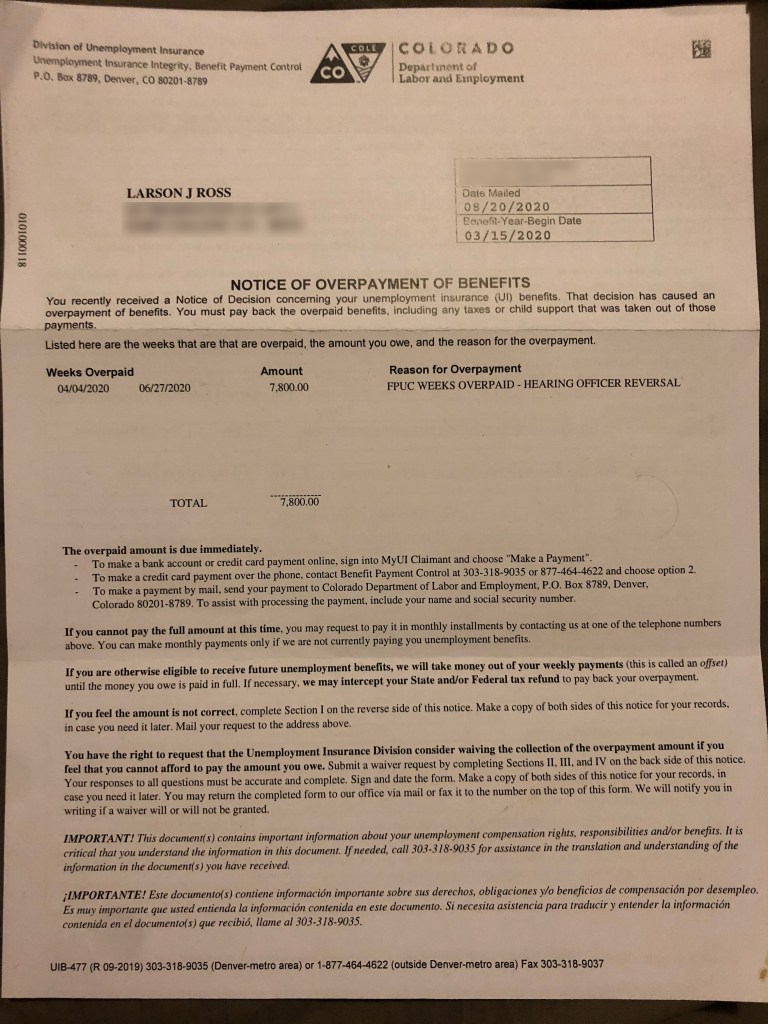

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Post a Comment for "Unemployment Benefits Tax Break"