How To Fill Out The Employee's Withholding Certificate

This form is fillable. Send the original signed form to the BSC.

How And Why To Adjust Your Irs Tax Withholding Bankrate Com Irs How To Find Out Irs Taxes

How And Why To Adjust Your Irs Tax Withholding Bankrate Com Irs How To Find Out Irs Taxes

More on that below and how to fill out Form W-4 for the 2021 tax year and beyond.

How to fill out the employee's withholding certificate. When an employee has more. Enter the employees personal information including Social Security number in the fields provided. Place the total from line G in the box labeled 5.

The way you fill out IRS form W-4 Employees Withholding Allowance Certificate determines how much tax your employer will withhold from your paycheck. Watch this video to learn why updating your W-4. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file.

Your employer sends the money it withholds from your paycheck to the Internal Revenue Service IRS along with your name and Social Security number. If you are single have one job have no children have no other income and plan on claiming the standard deduction on your tax return you only need to fill out Step 1 your name address Social Security number and filing status and Step 5 your signature. Request for Transcript of Tax Return.

Consider completing a new Form W-4 each year and when your personal or financial situation changes. Employers Quarterly Federal Tax Return. It is very important to complete Step 5 which is where you will sign and date the W-4 document.

Sign your name on the Employees Signature line and date. Employees Withholding Allowance Certificate Form NJ-W4 Employees should complete an Employees Withholding Allowance Certificate and give it to their employer to declare withholding information for New Jersey purposes. Other taxpayers will need to complete additional steps.

No more withholding allowances. May 14 2019 admen Advices. It may have been one of many documents you had to complete for your employer but because you can update it at any time you may want to think about submitting a new one.

If you have more than one job or your spouse works youll need to fill out Step 2. Fill out your personal information This is where youll input your name address and Social Security number. Employees Withholding Certificate or widely known as Form W-4 is the withholding tax form for employees to use.

Simply complete the worksheet and then you can transfer your information to Page one of the W-4 Employees Withholding Certificate. The biggest change is that the employees cant use the W-4 form to claim withholding allowances. Type in your personal information int he top section.

The purpose of Form W-4 is simple. The Job Shop will. Ask all new employees to give you a signed Form W-4 when they start work.

Start filling out 2021 Form W-4 online. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected. Request for Taxpayer Identification Number TIN and Certification.

To know how much income tax to withhold from employees wages you should have a Form W-4 Employees Withholding Certificate on file for each employee. If youre a single filer all you need to do is sign and date the form. When you started your last job do you remember filling out a W-4 form.

The previous version of Form W-4s title was Employees Withholding Allowance Certificate The redesigned Form W-4 for 2020 no longer calculates allowances so the title has been updated to Employees Withholding Certificate. It may have been one of many documents you had to complet. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Make the form effective with the first wage payment.

How To Fill Out Form W 4 2021 Withholding Guide Nerdwallet Changing Jobs Online Broker Irs Website

How To Fill Out Form W 4 2021 Withholding Guide Nerdwallet Changing Jobs Online Broker Irs Website

How To Fill Out Your W4 Tax Form W4 Tax Form Tax Forms Securities And Exchange Commission

How To Fill Out Your W4 Tax Form W4 Tax Form Tax Forms Securities And Exchange Commission

How To Fill Out A W 4 Form For A New Job Employee Tax Forms Tax Forms New Job

How To Fill Out A W 4 Form For A New Job Employee Tax Forms Tax Forms New Job

Fillable W 4 Form W2s W4s And W9s Facts Financing Tax Forms Employee Tax Forms Business Letter Template

Fillable W 4 Form W2s W4s And W9s Facts Financing Tax Forms Employee Tax Forms Business Letter Template

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

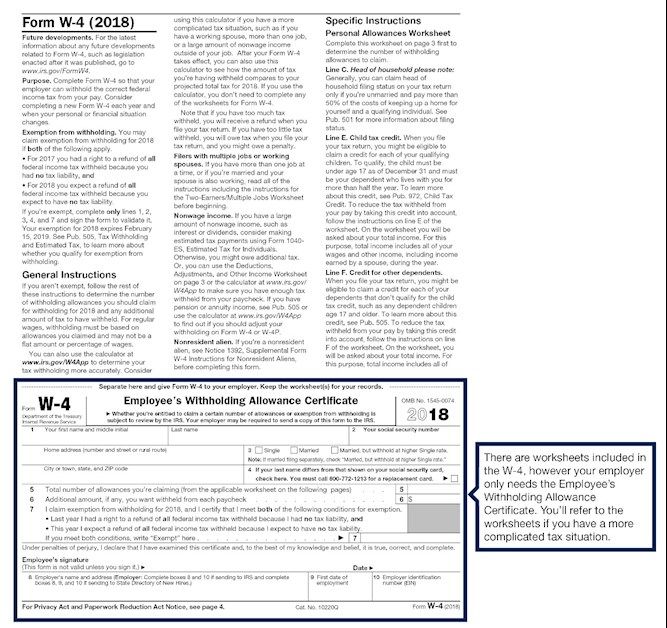

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

Copy Of W8 Form Seven Top Risks Of Copy Of W8 Form Employee Tax Forms Shocking Facts Tax Forms

Copy Of W8 Form Seven Top Risks Of Copy Of W8 Form Employee Tax Forms Shocking Facts Tax Forms

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

Blank W 13 Form 13 Shocking Facts About Blank W 13 Form Employee Tax Forms Shocking Facts Tax Forms

Blank W 13 Form 13 Shocking Facts About Blank W 13 Form Employee Tax Forms Shocking Facts Tax Forms

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms Employee Tax Forms The Motley Fool

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms Employee Tax Forms The Motley Fool

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

New W4 Form Coming For 2employee S Withholding Allowance Certificate Federal Income Tax Printable Chart Bookkeeping

New W4 Form Coming For 2employee S Withholding Allowance Certificate Federal Income Tax Printable Chart Bookkeeping

Tax Form New Employee 13 Unconventional Knowledge About Tax Form New Employee That You Can Tax Forms Employee Tax Forms Business Letter Template

Tax Form New Employee 13 Unconventional Knowledge About Tax Form New Employee That You Can Tax Forms Employee Tax Forms Business Letter Template

Fillable W 4 Form How To Fill Out Irs W4 Form Correctly And Maximize It For Proposal Writer Job Application Form Form

Fillable W 4 Form How To Fill Out Irs W4 Form Correctly And Maximize It For Proposal Writer Job Application Form Form

Fillable W 4 Form W 4 Form Irs How To Fill It Out Definitive Guide Tax Forms Obamacare Facts Income Tax

Fillable W 4 Form W 4 Form Irs How To Fill It Out Definitive Guide Tax Forms Obamacare Facts Income Tax

The Irs Has Developed A New Form W 4 Employee S Withholding Certificate For 2020 And It Is Very Different From Pas Small Business Finance Tax Help Tax Season

The Irs Has Developed A New Form W 4 Employee S Withholding Certificate For 2020 And It Is Very Different From Pas Small Business Finance Tax Help Tax Season

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form W2 Forms

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form W2 Forms

Post a Comment for "How To Fill Out The Employee's Withholding Certificate"