Can I Work As An Independent Contractor On Opt

Also unlike an employee you cant wait until April 15 to pay all of your taxes due for the previous year. Have been granted OPT and currently be in a valid period of post-completion OPT.

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

If you dont know what these are check out my post from last week.

Can i work as an independent contractor on opt. If your combined OPT employment is under 20 hours per week in. If you are working on 1099 you are self-employed ie you are working for your own one-person company. The following types of employment are authorized while on OPT and STEM OPT.

Independent contractor opt 8 Answers. OPT is employment related to your field of study and authorized by USCIS and working as a contractor is self-employment. F 1 Add Edit Delete Optional Practical Training OPT Employer.

If you intend to use this source of employment for OPT status discuss with your DSO. Under standard post-completion OPT you receive a 90 day allotment to be unemployed. F-1 Add Edit Delete Optional Practical Training OPT Employer.

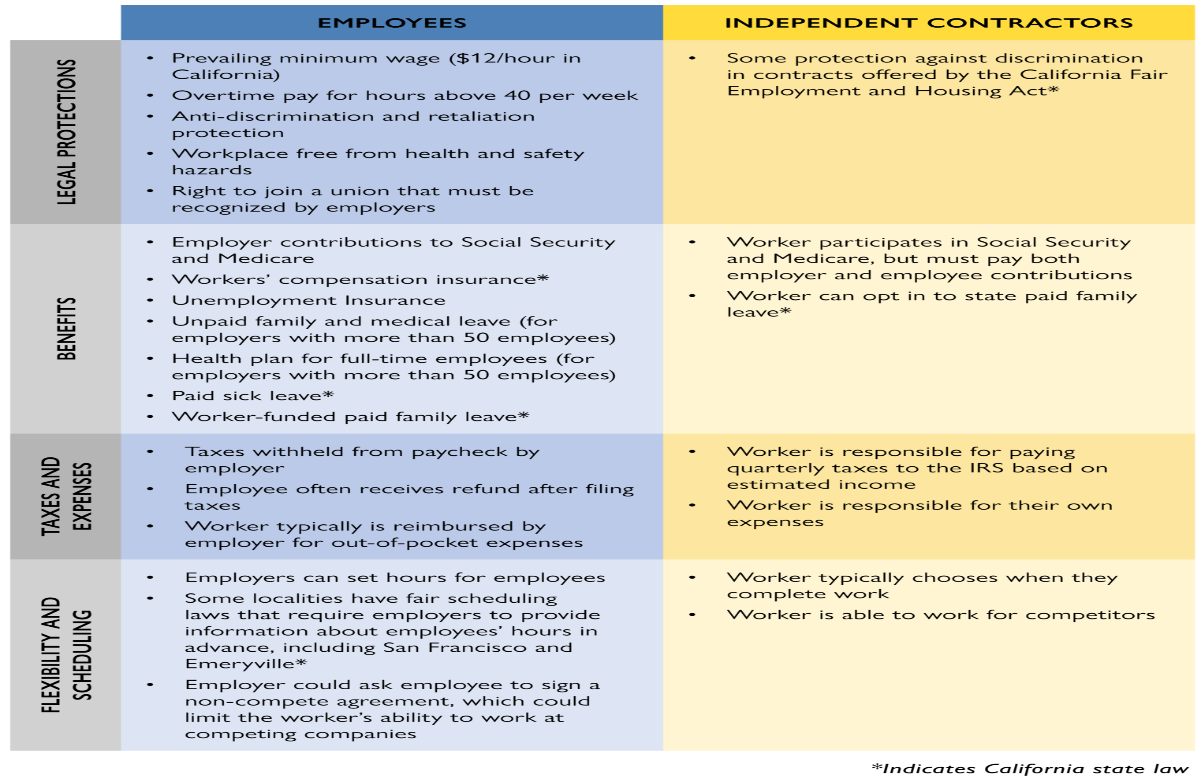

With the new tax laws benefitting independent contractors with a 20 deduction from their income now is a good time for companies to re-assess any personsentities which may be. You may work for multiple employers including short-term gigs self-employment contract work or work for hire. If you have 12 months or more of full-time CPT you are ineligible for OPT but part-time CPT is fine and will not stop you from doing OPT.

In order for your OPT employment to be considered active you must be working 20 hours per week or more between all OPT jobs combined. Commonly referred to as 1099 or Independent Contractor Employment. The End Date must be before the actual OPT approved period of work.

Once the OPT expires you can no longer work on 1099 as an IC. You should be able to prove that you have the proper business licenses and. When you work as an independent contractor you have to pay income tax just like an employee.

The ICE policy guidance refers to it as work for hire and you are authorized to spend your OPT working that way. Yes you can as long as you do so while on Optional Practical Training OPT approved by your school. CPT requires a signed cooperative agreement or a letter from your employer.

As far as the H1-B visa is concerned you will need to have an employer sponsor you and the group practice may not qualify as an employer under the USCIS regulations if you are working for them as an independent contractor. Check with your DSO if you like. It will not qualify for OPT or CPT or STEM OPT.

You can work on CPT either full-time or part-time. So you would have to enroll your one-person company in e-Verify. You may work for more than one employer on STEM OPT but each employment occurrence must be related to your stem STEM field of study and must be for at least 20 hours per week.

Keep evidence of the duration of contract periods and the name and address of the contracting company. To qualify for the 24-month extension you must. If you need a short answer yes you can.

I am holding F1 and working full-time 40hrsweek as an employee of. Enter the primary location where the student performs the work. Each separate STEM OPT employer must provide an I-983 Training Plan.

You absolutely cannot work without employment authorization and paid consultancy as an independent contractor would violate your F-1 status regardless of when you get paid or how you classify it. You cant work as an independent contractor as part of your OPT. On STEM OPT the company has to be enrolled in e-Verify.

Posted on Feb 15 2016. Working for a non-E-Verify employer puts you in violation of this request. You can work as an independent contractor.

When you receive the STEM extension you receive an additional 60 days allotment to be unemployed giving you a total of 150 days of unemployment during your entire OPT time. It is a technical violation of your visa to work as an independent contractor while on OPT but it is the EMPLOERs violation not yours and the USCIS knows this so they will NOT hold you responsible. There are couple of things that you need to consider.

Independent contractors and companies alike must be aware of this area of the law in order to avoid the myriad of problems which can arise from misclassifying a worker. Create an account or sign in to comment. I came to US as a grad student on F1 about 4 and a half years ago.

Self-employment must have the business set up and be enrolled in E-Verify for STEM OPT Employment as an independent contractor 1099 employment as opposed to being on the payroll. This is really a LEGAL question that is best posted in the Immigration Law portion of the LAW Forum. Department of Education-recognized accrediting agency and is certified by the Student and Exchange Visitor Program SEVP at the time you submit your STEM OPT.

For immigration purposes you can start a business or be self-employed while on OPT. Students authorized for an OPT STEM extension must work at least 20 hours per week for an E-Verify employer in a position directly related to each individual students STEM degree. Unlike an employee however you wont have any taxes withheld from your paycheck to cover income tax Social Security and Medicare.

Have earned a bachelors masters or doctoral degree from a school that is accredited by a US. Post-completion OPT can be paid or unpaid training related to your major field of study. While youre in F-1 status there are two ways that you can work in off-campus jobs.

For STEM OPT the new employer must be enrolled in E-Verify.

7 Essentials To An Independent Contractor Agreement Independent Contractor Contractors How To Memorize Things

7 Essentials To An Independent Contractor Agreement Independent Contractor Contractors How To Memorize Things

Employee Vs Independent Contractor What Employers Need To Know Legalzoom Com

Employee Vs Independent Contractor What Employers Need To Know Legalzoom Com

Independent Contractor Resignation Letter Template Free Pdf Word Apple Pages Google Docs Resignation Letter Letter Templates Resignation

Independent Contractor Resignation Letter Template Free Pdf Word Apple Pages Google Docs Resignation Letter Letter Templates Resignation

Independent Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Separation Agreement Template

Independent Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Separation Agreement Template

Most Independent Contractors Are Really Employees Employers Misclassify And That Can Lead To A Costly Labor Lawsuit Lubell Rosen Llc

Most Independent Contractors Are Really Employees Employers Misclassify And That Can Lead To A Costly Labor Lawsuit Lubell Rosen Llc

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Independent Contractor Vs Employee What S The Difference

Independent Contractor Vs Employee What S The Difference

Independent Contractor Timesheet Excel Of Contractor Invoice Throughout Timesheet Invoice Template Exc Invoice Template Word Invoice Template Estimate Template

Independent Contractor Timesheet Excel Of Contractor Invoice Throughout Timesheet Invoice Template Exc Invoice Template Word Invoice Template Estimate Template

Independent Contractor Taxes Guide 2021

Independent Contractor Taxes Guide 2021

An Independent Contractor S Guide To Taxes Smartasset

An Independent Contractor S Guide To Taxes Smartasset

How To Be Eligible For Independent Contractor Tax Status

How To Be Eligible For Independent Contractor Tax Status

Being An Independent Contractor Doordash Uber Grubhub Entrecourier

Being An Independent Contractor Doordash Uber Grubhub Entrecourier

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice Small Business Bookkeeping Bookkeeping Business Small Business Accounting

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice Small Business Bookkeeping Bookkeeping Business Small Business Accounting

How Do I Hire An Independent Contractor 5 Faqs Workest

How Do I Hire An Independent Contractor 5 Faqs Workest

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

Independent Contractor Agreement Contractor Contract Template Bonsai

Independent Contractor Agreement Contractor Contract Template Bonsai

Independent Contractor Agreement Sprout Law Small Business Tips Writing A Business Plan Contract Template

Independent Contractor Agreement Sprout Law Small Business Tips Writing A Business Plan Contract Template

Changes To New Jersey Laws Target Independent Contractor Misclassification And Mass Layoffs Employment Advisor Davis Wright Tremaine

Changes To New Jersey Laws Target Independent Contractor Misclassification And Mass Layoffs Employment Advisor Davis Wright Tremaine

This Template Is A Diy Independent Contractor Agreement Template This Is For When You Are Adding Another Team Mem Independent Contractor Contractors Templates

This Template Is A Diy Independent Contractor Agreement Template This Is For When You Are Adding Another Team Mem Independent Contractor Contractors Templates

Post a Comment for "Can I Work As An Independent Contractor On Opt"