Employer Withholding Tax Ohio

Online Services for Business. For detailed information regarding this subject see our information release at the link below.

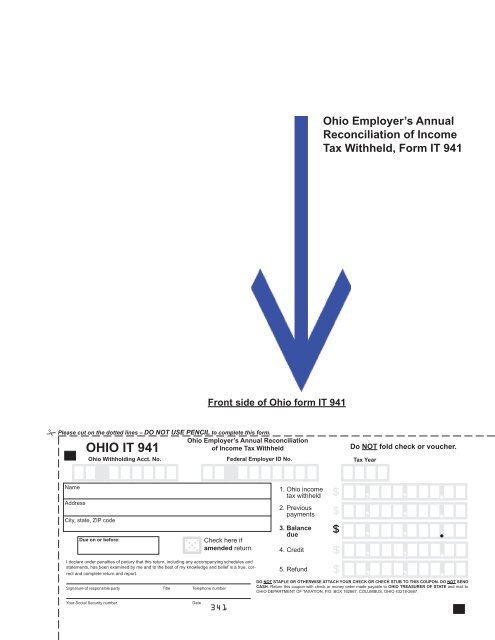

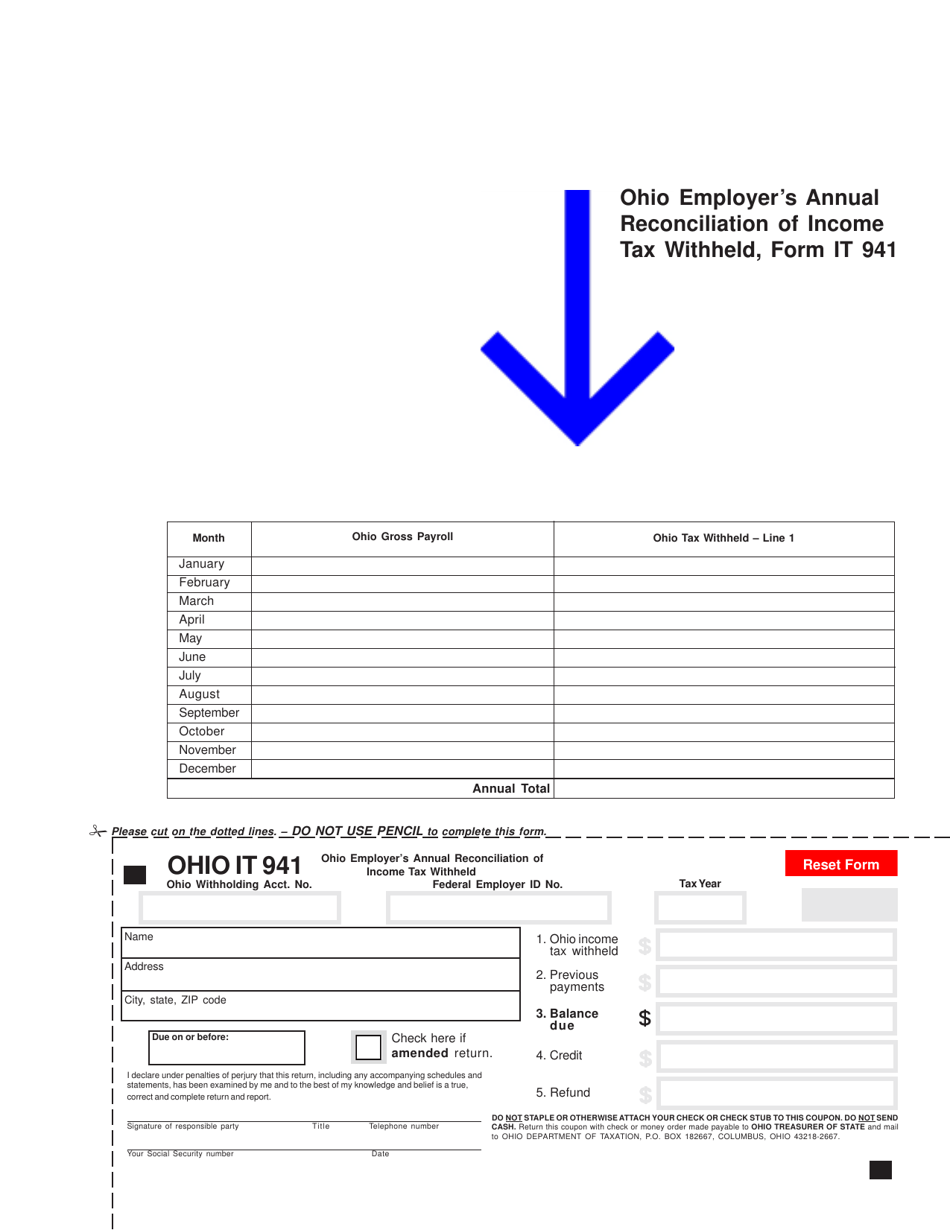

Ohio Employer S Annual Reconciliation Of Income Tax Withheld

Ohio Employer S Annual Reconciliation Of Income Tax Withheld

The employer is required to start withholding school district tax when notified by the employee submitting the form Ohio IT 4.

Employer withholding tax ohio. You cant get a refund unless it was improperly withheld ie. Magazine 15-T is a supplement paper for Magazine 15 of Guide for Employers Tax as well as Agricultural Employers Tax. Monthly remittance is required if your prior calendar year withholding exceeded 239900 or any month of the current years preceding quarter exceeds 20000.

With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the. January 1 2020 through December 31 2021. The employee is responsible for any tax due that was not paid through withholding when he files his Ohio SD 100 School District Income Tax Return when it.

Your employer is required to do that withholding. Ohio Department of Taxation. In addition if an employer or agent is not required to withhold for an employee but an employee request withholding for the municipality in which the employee resides then an employer may also withhold for that municipality.

Payments can be sent to Ohio CSPC by mail or electronically. Third-party payroll provider is required to withhold from each employee. State income tax withholding.

Employer Withholding Taxes - Returns and Payments. Commercial Activity Tax Sales and Use Tax Severance Tax and Horseracing Tax Casino IFTA Kilo Watt Hour Kilo Watt SAP Motor Fuel Natural Gas PAT FIT E911 Tire Fee Replacement Cigarette Tax Other Tobacco Products Tax and Master Settlement Agreement compliance areas will be unavailable for 1 hour starting at 530 pm on Saturday March 13 2021 for scheduled maintenance. House Bill 197 was an emergency piece of legislation that addresses how employers should be withholding local income taxes for employees while many are teleworking during the pandemic.

This results in the maximum amount of tax deducted. If an employee claims more than their natural dependents or claims to be exempt from Ohio withholding the employer is required to withhold Ohio income tax giving the employee zero exemptions. The Gateway also partners with local governments to enable businesses to file and pay selected Ohio municipal income taxes.

When it comes to tax withholding payroll primarily follows the rules of the state where the work is performed. An independent contractor can request that the employer withhold income taxes from the payments made to the independent contractor however the. The overview might be made use of by employers to compute the total amount of their workers withholding federal income tax from their incomes.

50 000000 8 digits must. Employer Federal Tax Withholding Tables 2021. Any employer agent of an employer or Other Payer not exceeding the thresholds stated above shall make quarterly payments.

Ohio Employees Should Not Change Municipal Tax Withholding On March 27 2020 Governor DeWine signed House Bill 197 into law. Teleworking Your Taxes. Ohio Withholding Account Number.

Workplace tax refers to a tax paid to a municipality in which an employee works regardless of where that employee livesResidence or courtesy withholding is a tax paid to an employees resident municipality for work performed outside that municipalityResidence tax is withheld in addition to the workplace withholding tax if any. Contact your municipality for registration information. Any Ohio city with an income tax is allowed to have withholding taken out of your pay while you worked in that city.

You didnt actually work there for all or part of the time that your employer was withholding. Employer Withholding Tables March 31 2020 Agency. If an employee works from home or lives and works in.

Under Ohio law each employer or agent of an employer ie. An employer is not required to withhold Ohio income tax from payments made to an independent contractor. 2020 2021 Tax Forms Fillable 2021 Business Tax Return Estimated Vouchers 2021 Individual Income Tax Return Estimated Vouchers 2021 Employer Municipal Withholding Booklet Quarterly Form WH-Q.

Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. If employees who live out of state come to your business for work payroll would follow the withholding rules for the state where your business is located. Financial institutions must begin withholding no later than 14 business days after the date of the notice and they must send the payment immediately to Ohio Child Support Payment Central CSPC but no later than 7 business days after the date the withdraw is made.

Https Tax Ohio Gov Portals 0 Ohiotaxalert Archivedalerts Helpfultipsewtandsdwt Pdf

Https Www Maumee Org Maumee 20mthly 20wh 20 202018 Pdf

Ohiocitytax Quick Lessons On Preparing Ohio City Income Tax Returns Page 4

Ohiocitytax Quick Lessons On Preparing Ohio City Income Tax Returns Page 4

Https Www Tax Ohio Gov Portals 0 Forms Employer Withholding 2019 Wth Instructions Pdf

Https Tax Ohio Gov Portals 0 Employer Withholding General 20guidelines 2020 20ohio 20employer 20withholding 20and 20school 20district 20withholding 20tax 20filing 20guidelines 1 0 Pdf

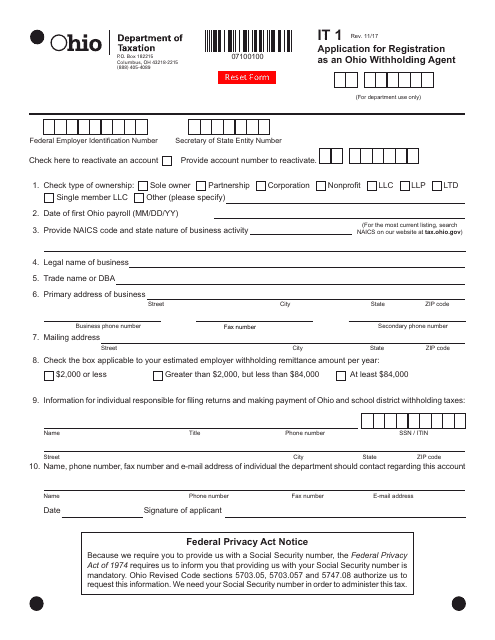

Form It1 Download Fillable Pdf Or Fill Online Application For Registration As An Ohio Withholding Agent Ohio Templateroller

Form It1 Download Fillable Pdf Or Fill Online Application For Registration As An Ohio Withholding Agent Ohio Templateroller

Https Www Tippcityohio Gov Documentcenter View 127 Withholders Pdf Bidid

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

Form It941 Download Fillable Pdf Or Fill Online Ohio Employer S Annual Reconciliation Of Income Tax Withheld Ohio Templateroller

Https Tax Ohio Gov Portals 0 Research Vta Nov2017 Session2 Pdf

Post a Comment for "Employer Withholding Tax Ohio"