Verbal Verification Of Employment Before Closing

Freddie Mac Single-Family SellerServicer Guide Bulletin 2016-23 Rev. Verification of employment often referred to as VOE is done during the mortgage process.

Will Your Lender Verify Employment On The Day Of Your Closing Irrrl

Will Your Lender Verify Employment On The Day Of Your Closing Irrrl

This helps the lender determine that your income is as accurate as you reported.

Verbal verification of employment before closing. 23 2020 for all loans in process and are effective for loans with application dates on or before Apr. The same job or a different one. These temporary flexibilities became effective on Mar.

Verbal verification of employment Updated Jan. Borrowers who were employed at the time of the current loan closing must still be earning income at the time of their new loan closing. This is usually accomplished via a phone call between the lender and a representative from your employer.

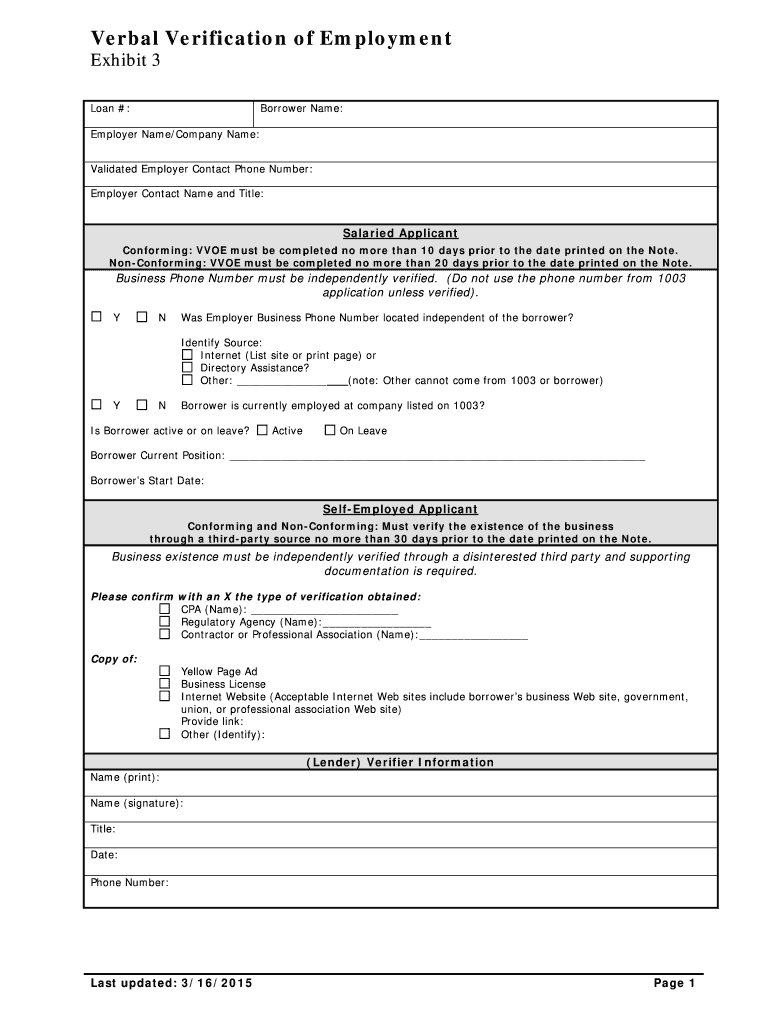

An email directly from the employers work email address that identifies the name and title of the verifier and the borrowers name and current employment status may be used in lieu of a verbal VOE. Specifically the FHFA states that in the event lenders cannot obtain verbal verification of the borrowers employment before loan closing the Enterprises will allow lenders to obtain. The loan is closed and delivered.

Employment verification before closing From my experience although not much verbal voe would have been done before loan docs were sent to title. The requirement for last. There are two types of VOEs.

Your employer is called no more than 10 days before the loan closure or 120 days if youre self-employed. The income can come from. Mortgage lenders usually verify the amount and stability of income used to qualify for a purchase or refinance loan.

102716 and 121516 eff. Typically mortgage lenders conduct a verbal verification of employment VVOE within 10 days of your loan closing meaning they call your current employer to verify youre still working for. Most lenders use a verification of employment form to verify a borrowers employment.

Lenders always verify employment before you close on a loan. Employment status within the same timeframe as the verbal VOE requirements. Verification Of Employment is how lenders verify the borrower is employed with a particular company and the official wages they make.

Written VOEs and Verbal VOE. Lenders need to hear from a third party that you are employed. Verbal Verification of Employment VVOE For many borrowers with a single consistent income stream a Verbal Verification of Employment VVOE can suffice.

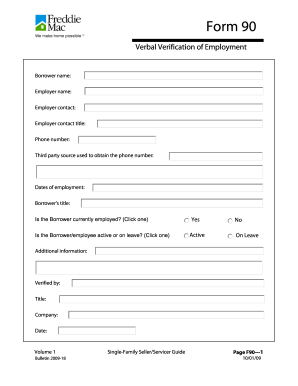

The lender contacts the borrowers employer and verifies the employment and payroll information of. 070617 Page F90-1 Form 90 Verbal Verification of Employment Borrower name. Verbal Verification of Employment VVOE is the process of verifying the employment status of each borrower on the mortgage application by contacting the borrowers employer over the phone.

Although banks generally require verification from your current employer a lender may also want to verify your past employment. We will conduct a verbal Verification of Employment VVOE before the refinance can close. You must sign the form authorizing an employer to release your information.

If youre self-employed youll be much more involved in the verbal verification of employment process. The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. This is from my experience working with a wholesale lender.

The verbal VOE requirement is intended to help lenders mitigate risk by confirming as late in the process as possible that the borrower remains employed as originally disclosed on the loan. Defining the Verification of Employment. A borrowers employment is a significant factor in.

Its not enough to supply your paystubs or even your tax returns. How a verbal verification of employment works Fannie Mae Freddie Mac or government-backed loans require lenders to confirm the accuracy of the documents you provide when applying for a home loan. The call is documented and your employment is confirmed with the employer.

Get Matched with a Lender Click Here.

Verification Of Employment Before Closing Mortgage Guidelines

Verification Of Employment Before Closing Mortgage Guidelines

Verification Of Employment Before Closing Mortgage Guidelines

Verification Of Employment Before Closing Mortgage Guidelines

Why Do Lenders Have To Verify My Employment Zing Blog By Quicken Loans

Why Do Lenders Have To Verify My Employment Zing Blog By Quicken Loans

Verification Of Employment Voe For Va Loans

Verification Of Employment Voe For Va Loans

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

How Do Mortgage Lenders Verify Employment Before Closing

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

How Do Mortgage Lenders Verify Employment Before Closing

How Do Mortgage Lenders Verify Employment Before Closing

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Https Singlefamily Fanniemae Com Media 22801 Display

Temporary Exceptions For Usda Appraisals Inspections And Employment Verification Usda Loan Pro

Temporary Exceptions For Usda Appraisals Inspections And Employment Verification Usda Loan Pro

Verification Of Employment Before Closing Mortgage Guidelines

Verification Of Employment Before Closing Mortgage Guidelines

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Mortgage Approval Without Employment Verification

Verbal Voe Form Fill Online Printable Fillable Blank Pdffiller

Verbal Voe Form Fill Online Printable Fillable Blank Pdffiller

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Loan Application Save Yourself Home Loans

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Loan Application Save Yourself Home Loans

Verbal Verification Of Employment Form Fill Online Printable Fillable Blank Pdffiller

Verbal Verification Of Employment Form Fill Online Printable Fillable Blank Pdffiller

Will My Lender Do An Employment Verification After Closing Clever Real Estate

Will My Lender Do An Employment Verification After Closing Clever Real Estate

Post a Comment for "Verbal Verification Of Employment Before Closing"