Md Employment Tax Forms

The Maryland Division of Unemployment Insurance will implement a new data system in the second half of 2019. Our responsibilities include collecting quarterly unemployment insurance contributions from liable employers and paying unemployment benefits to entitled individuals.

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Annuity and Sick Pay Request for Maryland Income Tax Withholding.

Md employment tax forms. Forms - Maryland Department of Labor Other forms are offered as online applications that are completed online or e-mailed automatically. If you receive a 1099-G tax form but did not apply for or receive unemployment insurance benefits in Maryland in 2020 then please complete this Affidavit form and submit it along with picture ID to the Benefit Payment Control Unit by e-mailing dlui1099-labormarylandgov. Your current certificate remains in effect until you change it.

Round 464327 to 4643 Maryland Unemployment Insurance Quarterly Employment Report 181818 Valid reasons for not entering wages on this page follow. Maryland long form for full- or part-year residents. Enter on line 1 below the number.

Request for Wage Adjustment form DLLRDUI 21. There are complete instructions on Central Payrolls Website. Division of Unemployment Insurance.

45 Calvert Street Annapolis MD 21401. If you are a new Employer and need to create a Maryland UI Account register your account by selecting Register for an Account. Call 2-1-1 or 1-800-492-0618 for more information about the Earned Income Tax Credit and about locations for FREE tax preparation.

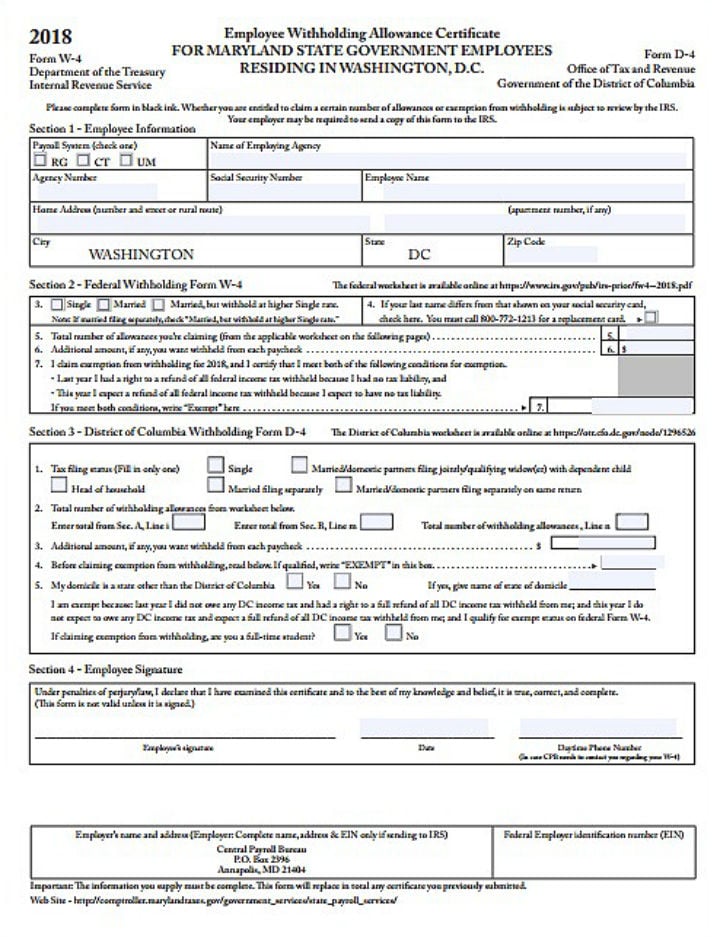

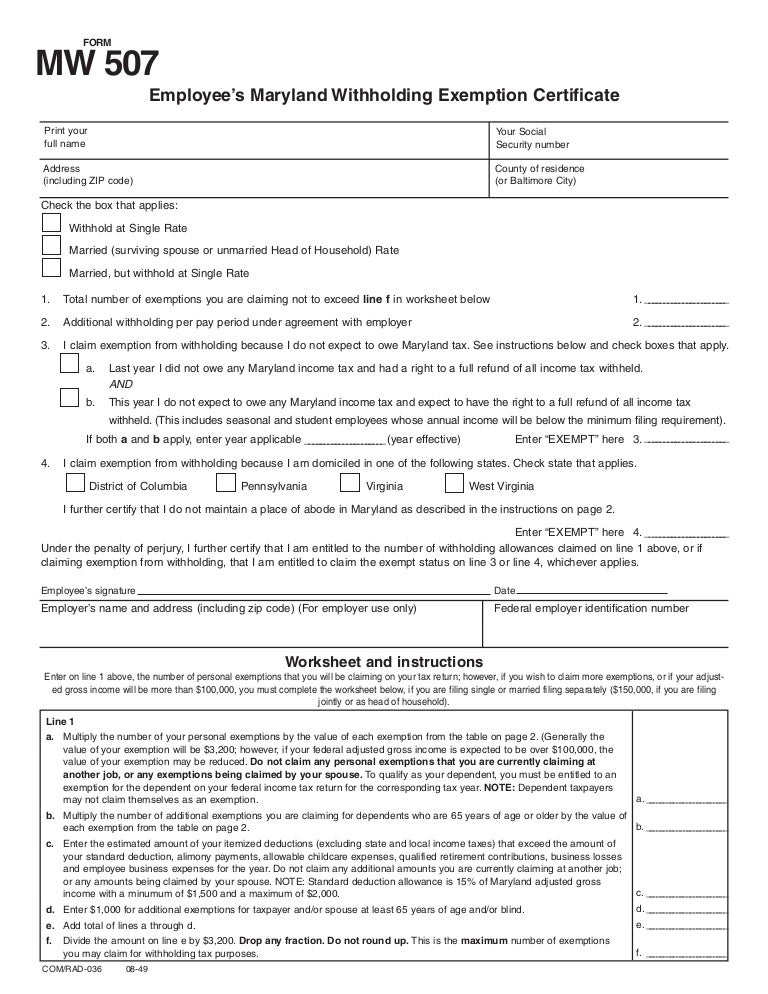

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents you must file Form 515. Request For Investigation of Unemployment Insurance Fraud. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay.

Form used by recipients of annuity sick pay or retirement distribution payments that choose to have Maryland income tax withheld from each payment. Income Tax 1099G Information - Unemployment Insurance Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance UI benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year.

Toll Free 800 705-3493. Omit dashes in social security numbers and commas and decimal points in wage amounts. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

Maryland Tax Alert 31121. Use this report to notify the Maryland Department of Labor when transferring workforce or payroll from one business entity to another. Forms will be found throughout the Maryland Department of Labor website under the heading for the DivisionOfficeBoardCommission responsible for the form.

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Consider completing a new Form MW507 each year and when your personal or financial situation changes. Furthermore the State of Maryland released a Tax Alert on 31121 which states that all individual corporate pass-through entity and fiduciary income tax returns that otherwise would have been due on varying dates between January 1 2021 and July 15 2021 inclusive are now due on or before July 15 2021.

1 EMPLOYER NAME 2 EMPLOYER NUMBER 3 FOR QTR ENDING 4 DUE DATE Round your entries to the nearest whole dollar. To make sure you are ready to use the new system and to get the latest information please visit our web page. The Contributions Division is dedicated to ensuring that eligible citizens of Maryland have access to unemployment insurance benefits when and if it is necessary.

If you did not receive unemployment benefits in 2020 you will not be responsible for paying taxes on that money once the Maryland Division of Unemployment. Students and other part-time workers affected by this situation may claim an exemption from withholding using Maryland Form MW507 Employees Maryland Withholding Exemption Certificate. 300-301 West Preston Street Baltimore MD 21201.

If you have an employee who expects to have less than 12000 in income during 2018 you are not required to withhold Maryland state and local income tax. 1099-Gs reflect Maryland UI benefit payment amounts issued within that calendar year. Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance UI benefits for the prior calendar year.

This may be different from the week of unemployment for which the benefits were paid. Special situations If you are self-employed or do not have Maryland income taxes withheld by an employer you can make quarterly estimated tax payments as part of a pay-as-you-go plan using Form PV. 9 rows Form used by individuals to direct their employer to withhold the correct amount of Maryland income tax from their pay.

18 rows Maryland Resident Income Tax Return. You should keep the completed MW507 certificate. Power of Attorney Authorization Form Use this form to request representation by a third party.

If you previously started a registration and need to complete it select Continue Registration Once you have created your login credentials you can access your Beacon account by selecting Login to my Account. For the Maryland EITC file tax form 502.

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

10 Employee Payroll Form Templates Free Premium Templates

10 Employee Payroll Form Templates Free Premium Templates

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What Is A W 9 Tax Form H R Block

What Is A W 9 Tax Form H R Block

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

Employee S Maryland Withholding Exemption Certificate

Employee S Maryland Withholding Exemption Certificate

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Form Mw507 Employee S Maryland Withholding Exemption Certificate

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Post a Comment for "Md Employment Tax Forms"