Employment Expenses Guide Cra

Form TL2 Claim for Meals and Lodging Expenses. Employees earning commission income can deduct the same.

These expenses are personal.

Employment expenses guide cra. Because of this strict rule many issues with employment expenses are black-and-white. The authorization and consent must contain a box with the authorization for the consumer to ask for a copy of the requested report and must advise the CRA of the consumers. If you are an employee and your employer requires you to pay expenses to earn your employment income you can use this guide.

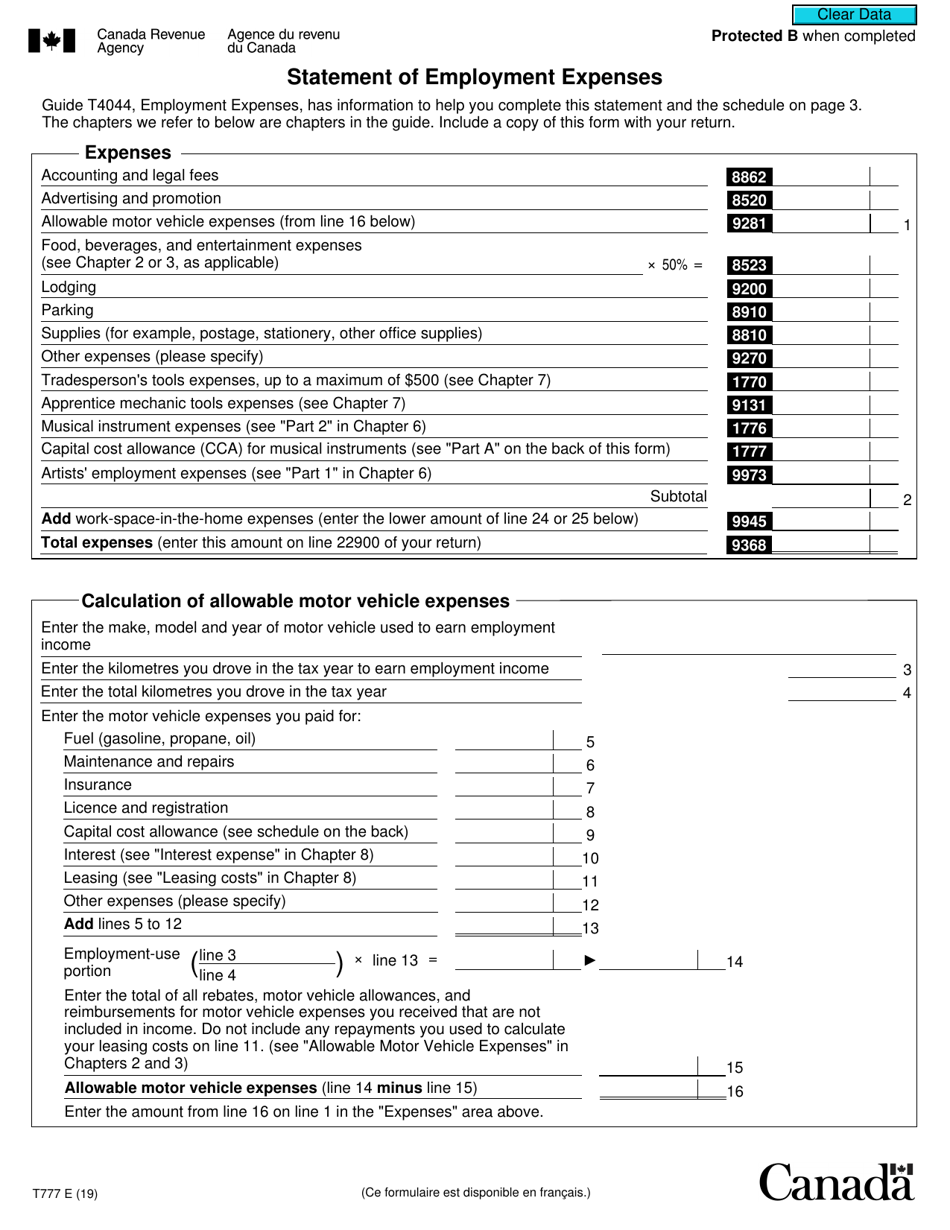

EXPENSE TYPE Wages and Other Employment Expenses to Independent Arms Length Third Parties Rent Lease - Real Estate Rent Lease - Capital Equipment Insurance Property Tax Telephone and Utilities Gas Oil Electricity Water Internet Payments for regularly scheduled debt service Independent Contractor Fees License Fees. T4044 Employment Expenses 2020 - Includes forms T777S T777 TL2 T2200S T2200 and GST370. Employees allowable employment expenses.

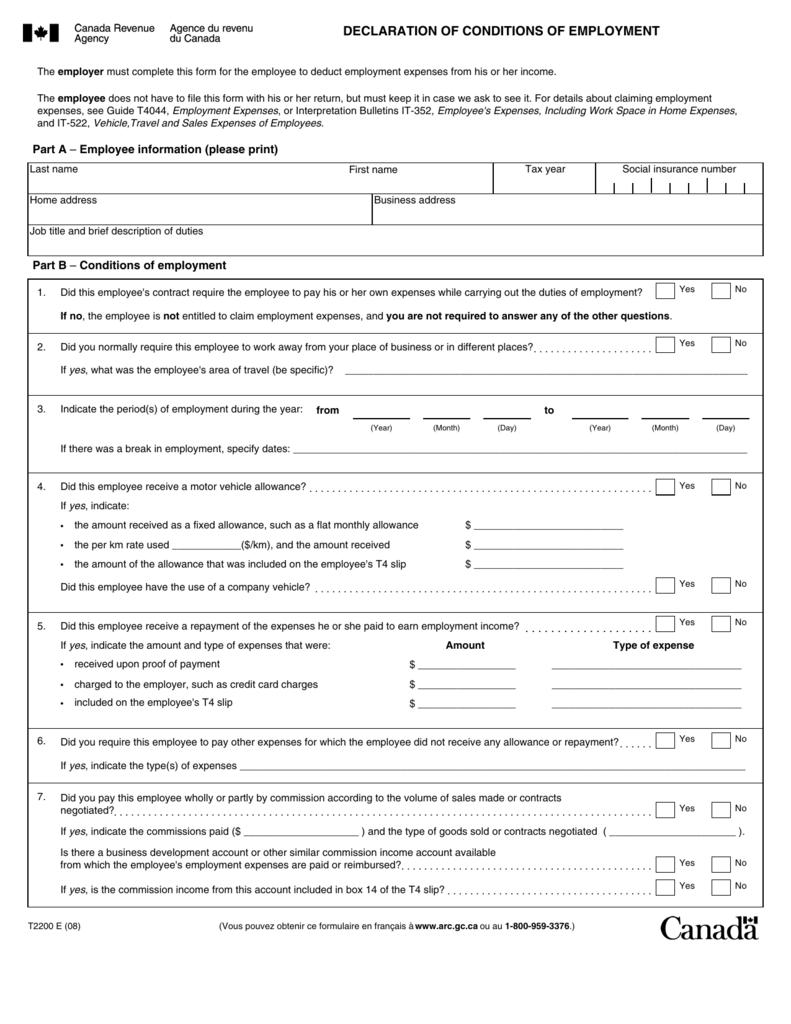

It will help you calculate the expenses you can deduct. Must Provide Special Form. Form T2200 Declaration of Conditions of Employment.

It also gives you all the information you need to claim the employee goods and services taxharmonized sales tax GSTHST rebate. Because you need to meet specific conditions to claim any expenses and the categories of expenses that can be. This contract of employment does not have to be in writing but you and your employee have to agree to the terms and understand what is expected.

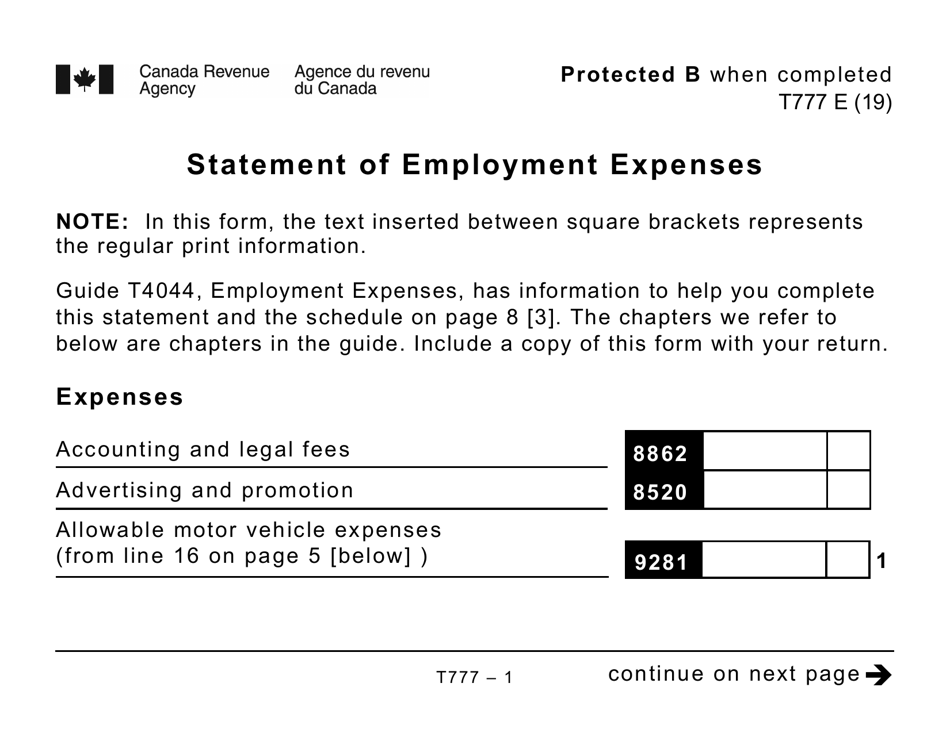

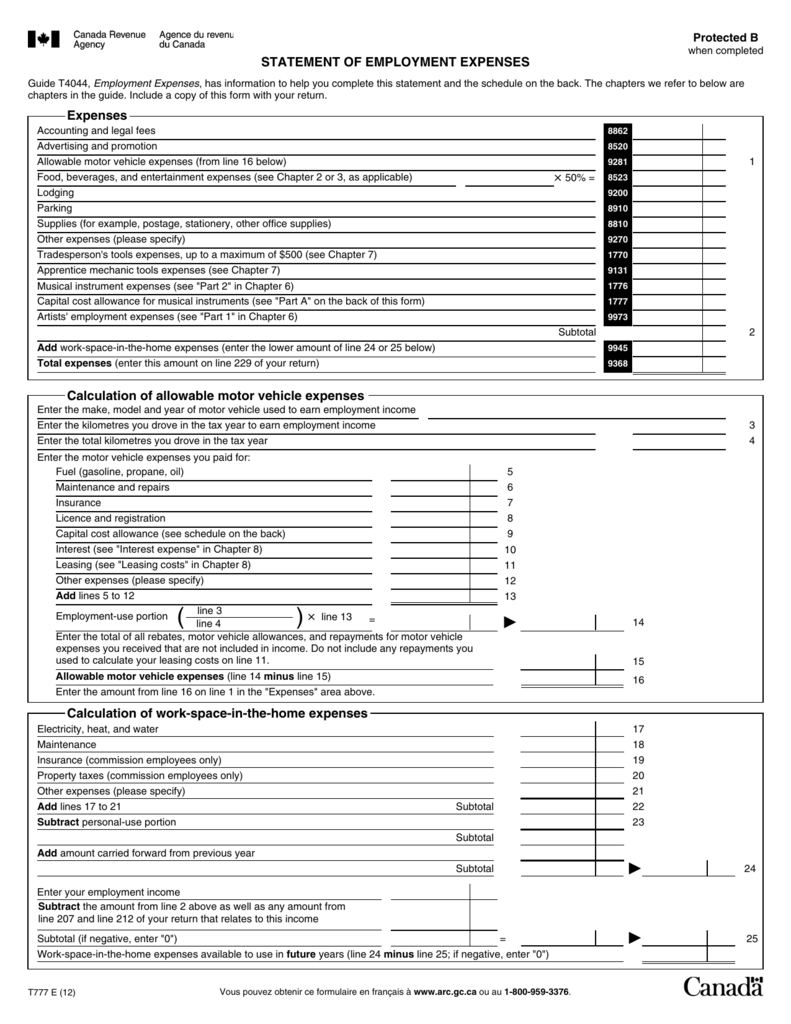

Form T777 Statement of Employment Expenses. An employer cannot require applicant to pay for pre-employment medical examination expenses. You include the amount of the meal and entertainment expenses in an employees income or would include them if the employee did not work at a remote or special work location.

See the statute here for more information. To find out how to get a tax package online or to request a printed copy go to CRA forms and publications. You can deduct a number of other expenses such as any licence fee that you paid to do your work salary paid to an assistant or a substitute office rent to earn commission income and training costs.

It will help you calculate the expenses you can deduct. Employee work-space-in-home expenses - includes info re working from home during the COVID-19 pandemic as well as information re those still working at the regular place of business but possibly incurring additional expenses. Employees meals and lodging expenses - transport and railway employees.

Employees need to be required to bear expenses by their employer through an employment contract in order to be in a position to claim deductible expenses off their gross income. If you are an employeeand your employer requires you to pay expenses to earn your employment income you can use this guide. It also gives you all the information you need to claim the employee goods and services taxharmonized sales tax GSTHST rebate.

You deduct most of your allowable employment expenses on line 229 of your income tax and benefit return. Enter the details of employment expenses on the T777WS. Since each T777WS is associated with a T4 slip create the slip first making sure to enter any commissioned income in.

Form T2200S Declaration of Conditions of Employment for Working at Home Due to COVID-19. The amounts from this worksheet flow to the T777 and GST370 forms if the taxpayer is claiming the GSTHST rebate on the expenses. In addition the amount cannot be paid or payable for a conference convention seminar or similar event and the special work location must be at least 30 kilometres from the closest urban centre with a.

Wwwcragcca Is this guide for you. Use this guide if you are an employee and your employer requires you to pay expenses to earn your employment income. Your employee may be able to claim certain employment expenses on their income tax and benefit return if under the contract of employment the employee had to pay for the expenses in question.

You cannot deduct the cost of travel to and from work or other expenses such as most tools and clothing. Glass Building with Red and White Sculpture by Katie Dories. Welcome to the new State of Oklahoma Website.

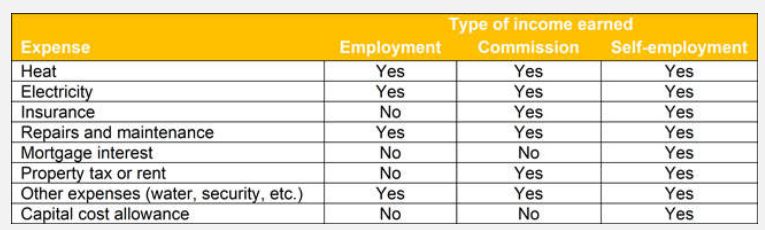

Form T777S Statement of Employment Expenses for Working at Home Due to COVID-19. The Tax Act permits employees to claim home office deductions for office rent and supplies consumed directly in the performance of employment duties. The CRAs guide T4044 Employment Expenses 2019 indicates that salaried employees can deduct supplies such as electricity heating and maintenance costs.

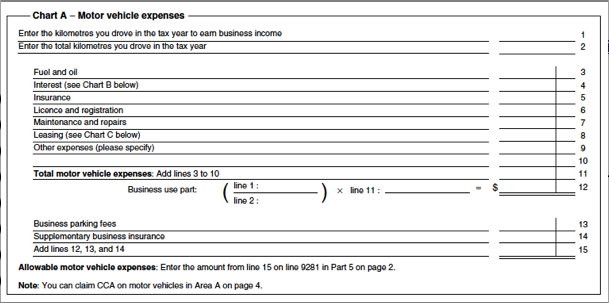

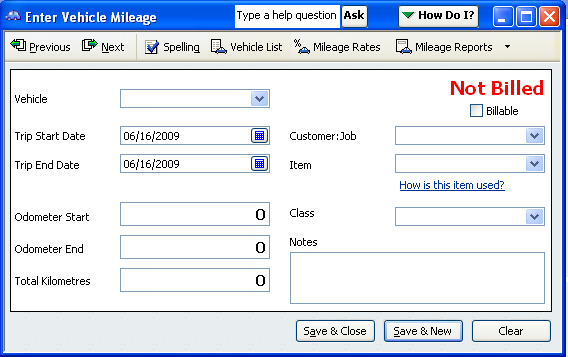

Employee motor vehicle travel expenses. Guide T4044 Employment Expenses. Refer to the Canada Revenue Agency CRA website for a full list of other expenses that can be deducted from your employment income.

In general employees may claim expenses if the employment contract requires them to pay their own expenses if they are usually required to work away from their employers place of business and if they do not receive a non-taxable allowance for travelling expenses.

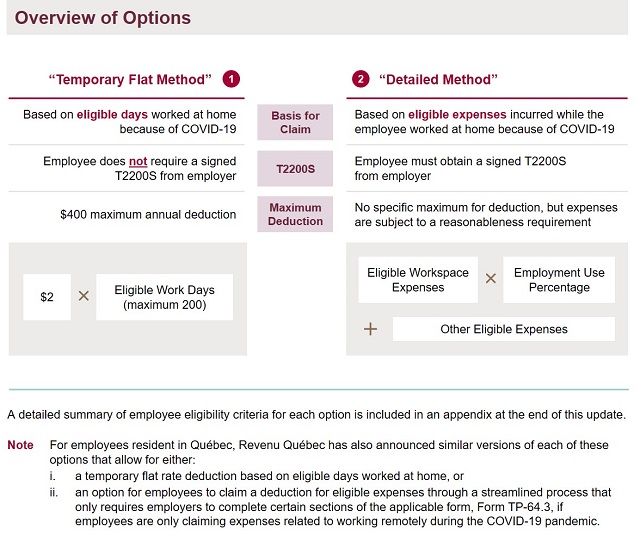

Working From Home During Covid 19 Coronavirus Covid 19 Canada

Working From Home During Covid 19 Coronavirus Covid 19 Canada

Https Carleton Ca Profbrouard Wp Content Uploads Notetaxhomeofficeexpenses202101enwihtcraforms Pdf

Declaration Of Conditions Of Employment Cra

Declaration Of Conditions Of Employment Cra

Business Vehicle Expenses Focus On Tax

Business Vehicle Expenses Focus On Tax

Part 5 Employment Expenses Pdf Free Download

Part 5 Employment Expenses Pdf Free Download

Procedures For Processing Article 19 2 Requests Declaration Of Conditions Of Employment Overview Manualzz

Procedures For Processing Article 19 2 Requests Declaration Of Conditions Of Employment Overview Manualzz

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

How And What You Can Claim Your Business Expenses On Your Taxes As A Blogger Canada Save Spend Splurge

How And What You Can Claim Your Business Expenses On Your Taxes As A Blogger Canada Save Spend Splurge

Kalfa Law Covid 19 Cra Home Office Expenses

Kalfa Law Covid 19 Cra Home Office Expenses

Form T777 Download Printable Pdf Or Fill Online Statement Of Employment Expenses Large Print 2019 Canada Templateroller

Form T777 Download Printable Pdf Or Fill Online Statement Of Employment Expenses Large Print 2019 Canada Templateroller

Employment Expense Disputes With The Cra Kalfa Law

Employment Expense Disputes With The Cra Kalfa Law

Germ Warfare Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

Germ Warfare Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

Kalfa Law Covid 19 Cra Home Office Expenses

Kalfa Law Covid 19 Cra Home Office Expenses

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

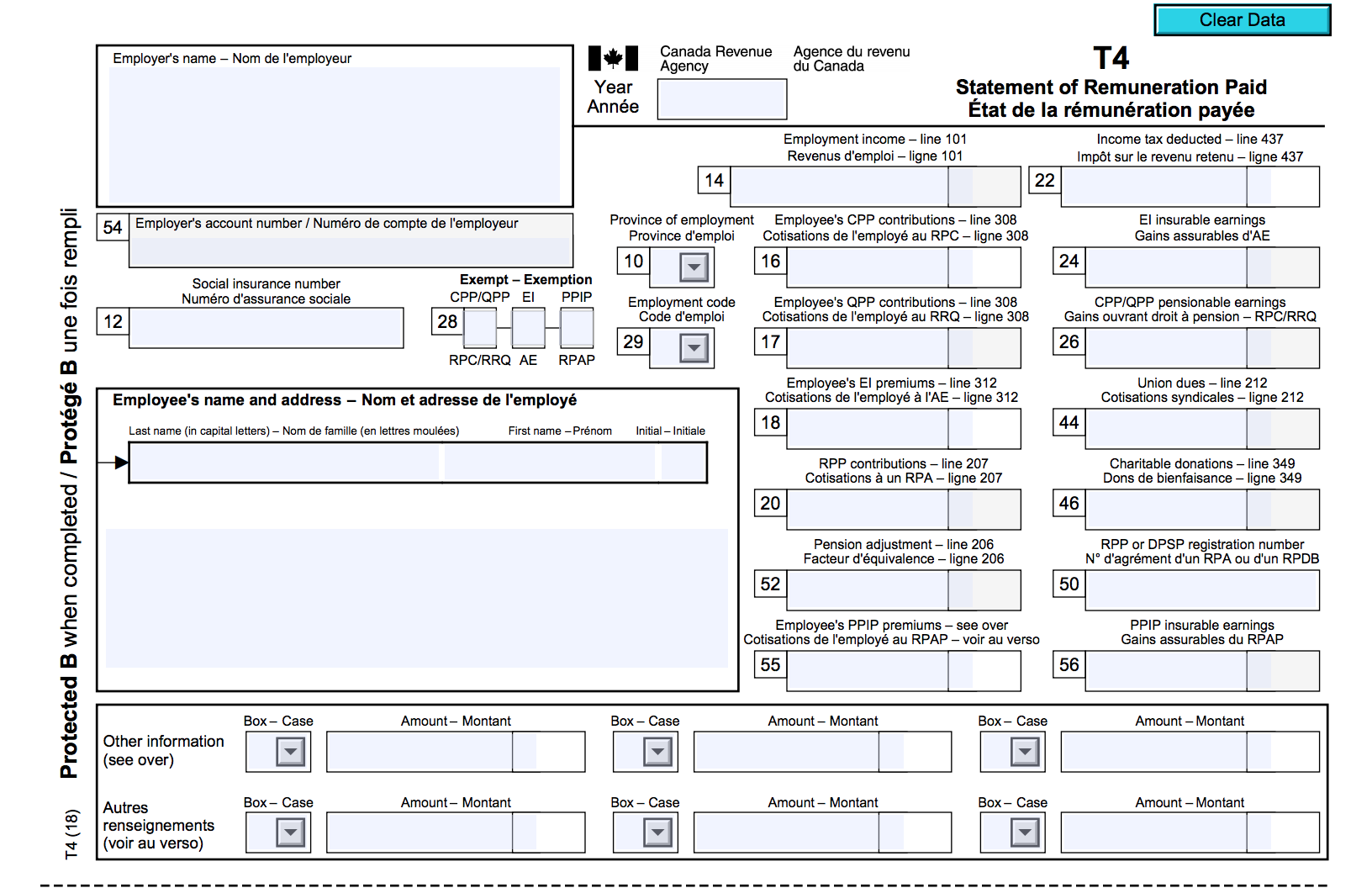

The Canadian Employer S Guide To The T4 Bench Accounting

The Canadian Employer S Guide To The T4 Bench Accounting

Post a Comment for "Employment Expenses Guide Cra"